Abstract:Before you invest your hard-earned money with any broker, it is always advisable to look at the red flags first. Not just the flashy offers and attractive websites. This article is a review of NeolinFX that warns traders and investors about its potential red flags.

Before you invest your hard-earned money with any broker, it is always advisable to look at the red flags first. Not just the flashy offers and attractive websites. This article is a review of NeolinFX that warns traders and investors about its potential red flags.

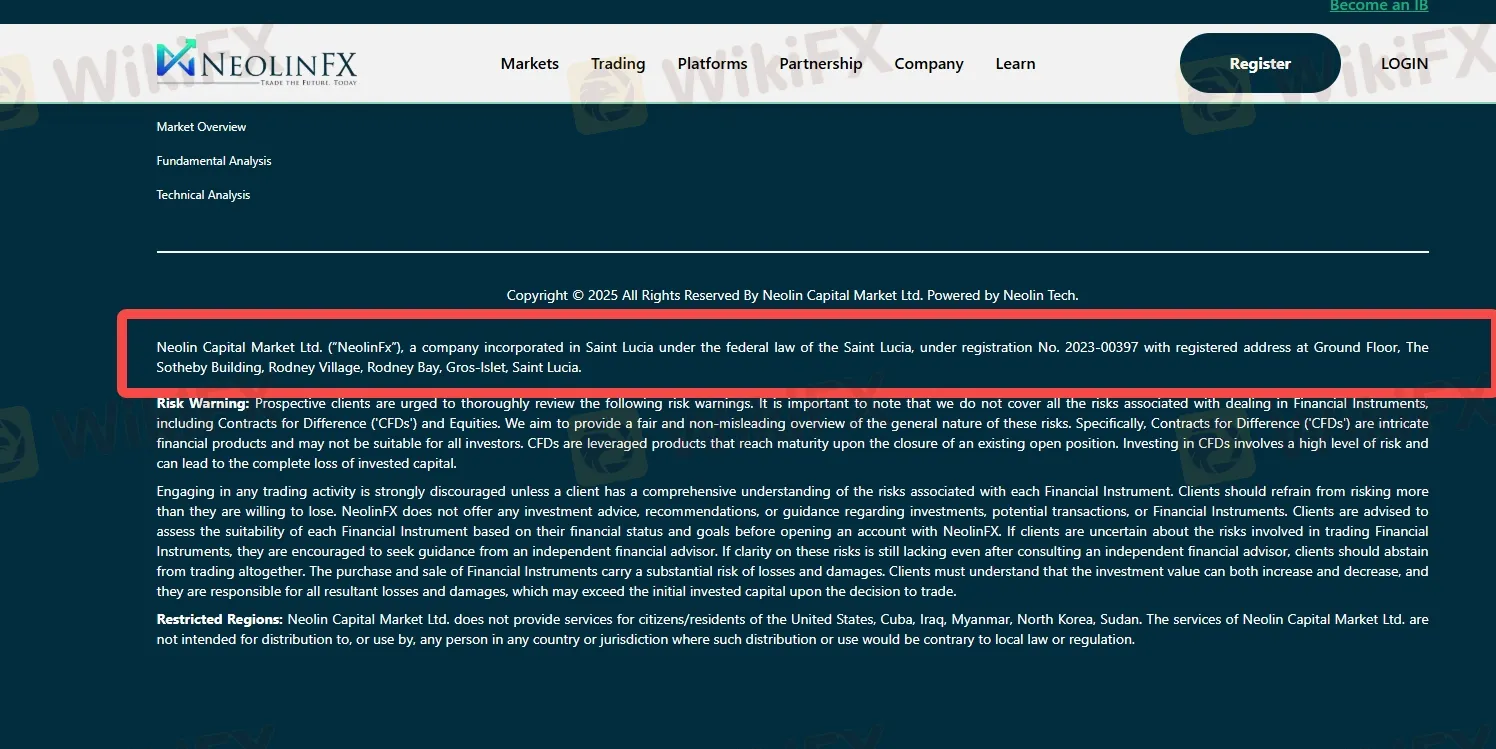

1. No Strong Regulation

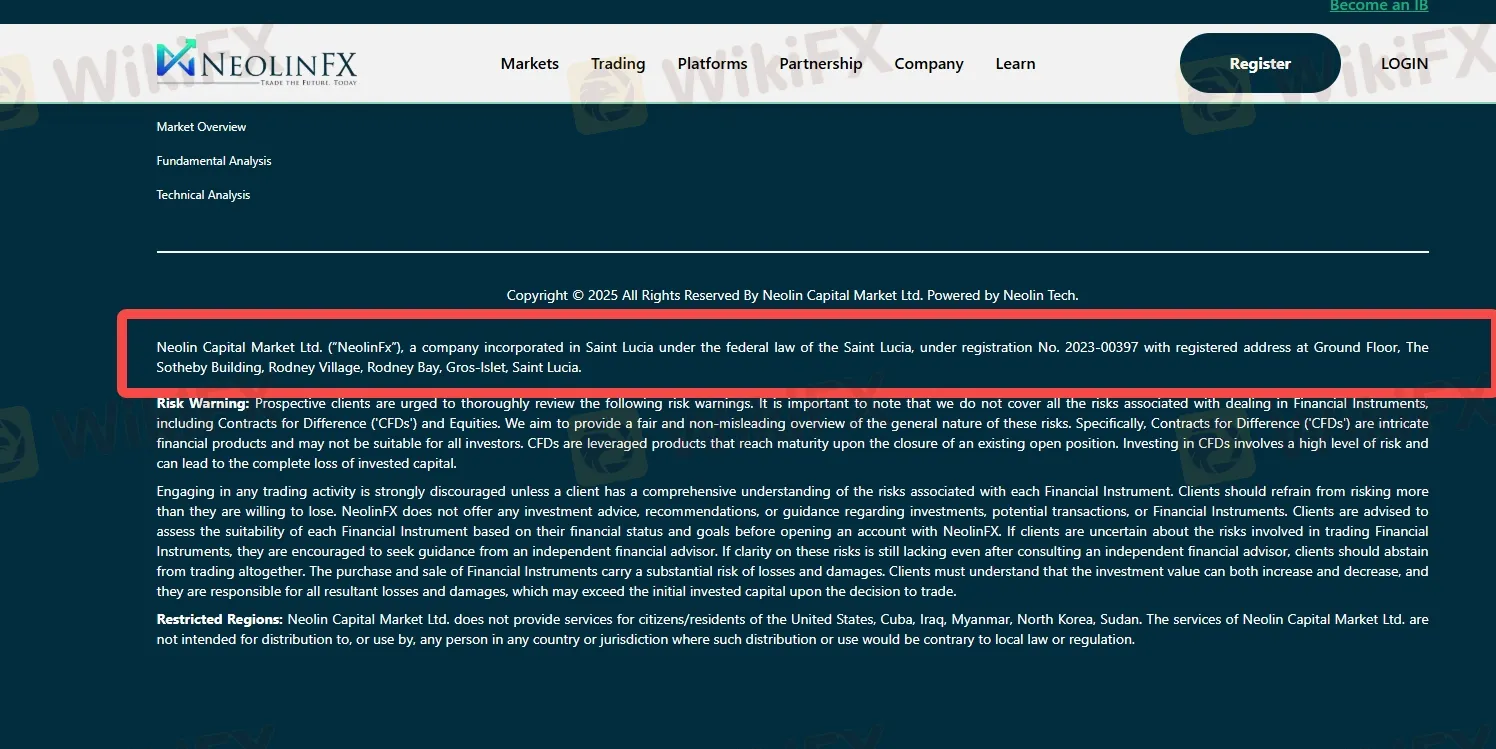

NeolinFX is owned by Neolin Capital Market Ltd., a company registered in Saint Lucia. While this might sound official, being registered in Saint Lucia does not mean the broker is well-regulated. The country has very weak rules for financial companies, which means there is little protection for traders. If anything goes wrong, it can be very hard to get your money back. A good broker should be licensed by a strong regulator like FCA, ASIC, or CySEC NeolinFX is not.

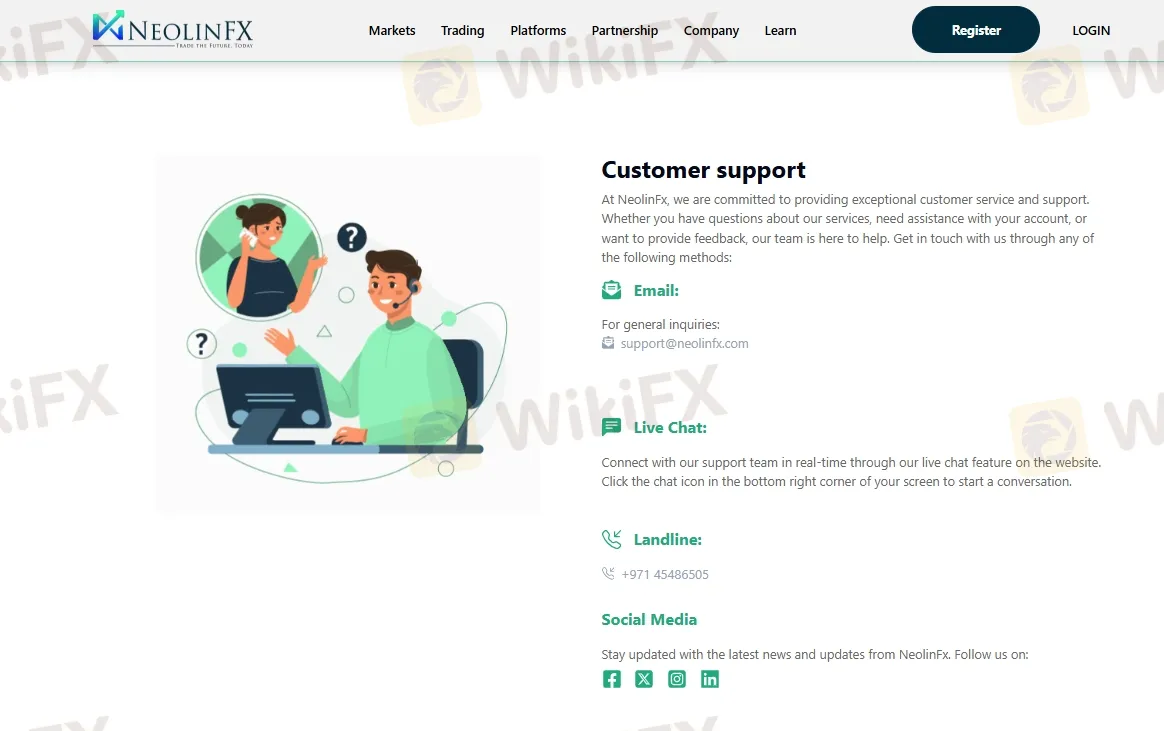

2. Physical Address Missing

Even though NeolinFX provides an email, phone number, and a contact form, they don‘t give a real, physical office address. This makes it hard to know where the company is really based or who is behind it. A trustworthy broker is usually open about their location and easy to contact. When a broker hides this information, it’s a big warning sign and raises serious doubts about their honesty.

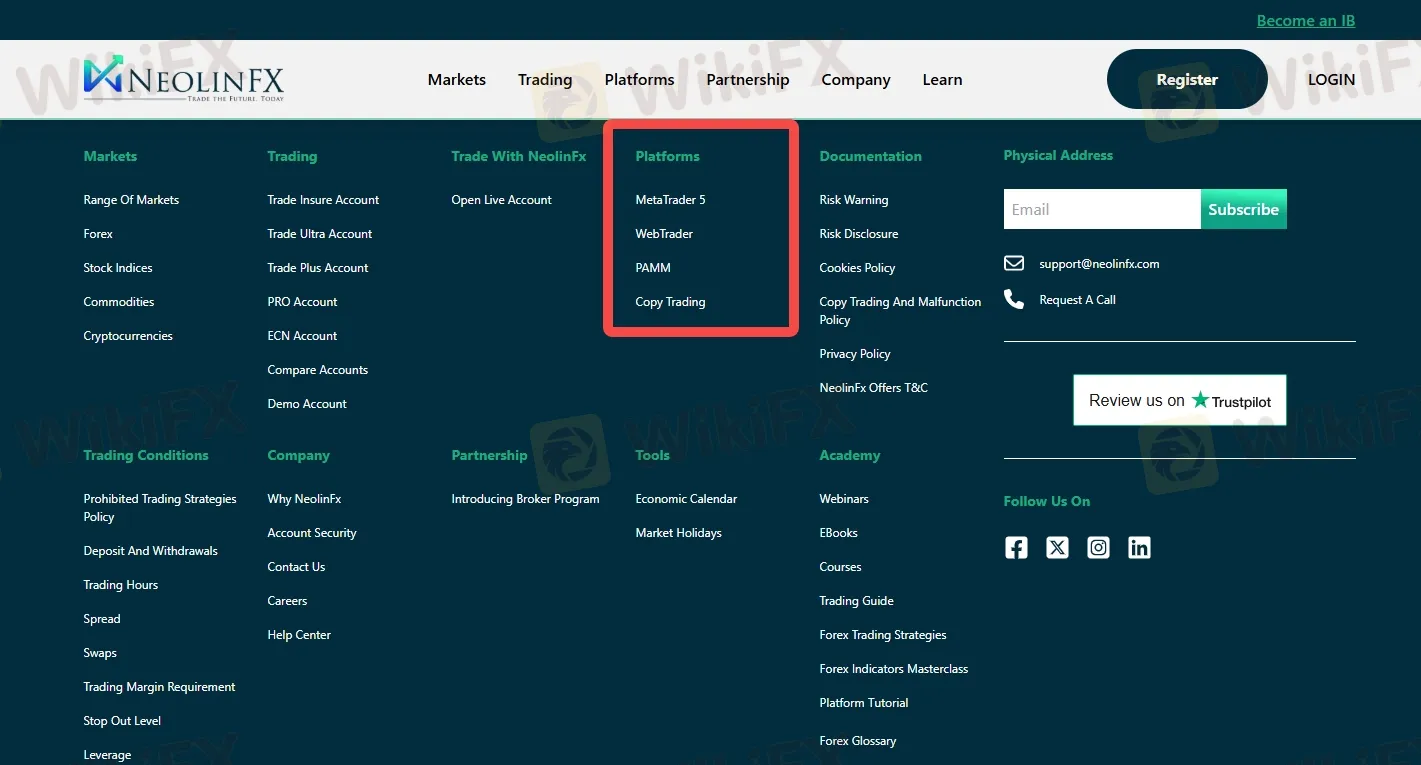

3. No MT4 Trading Platform

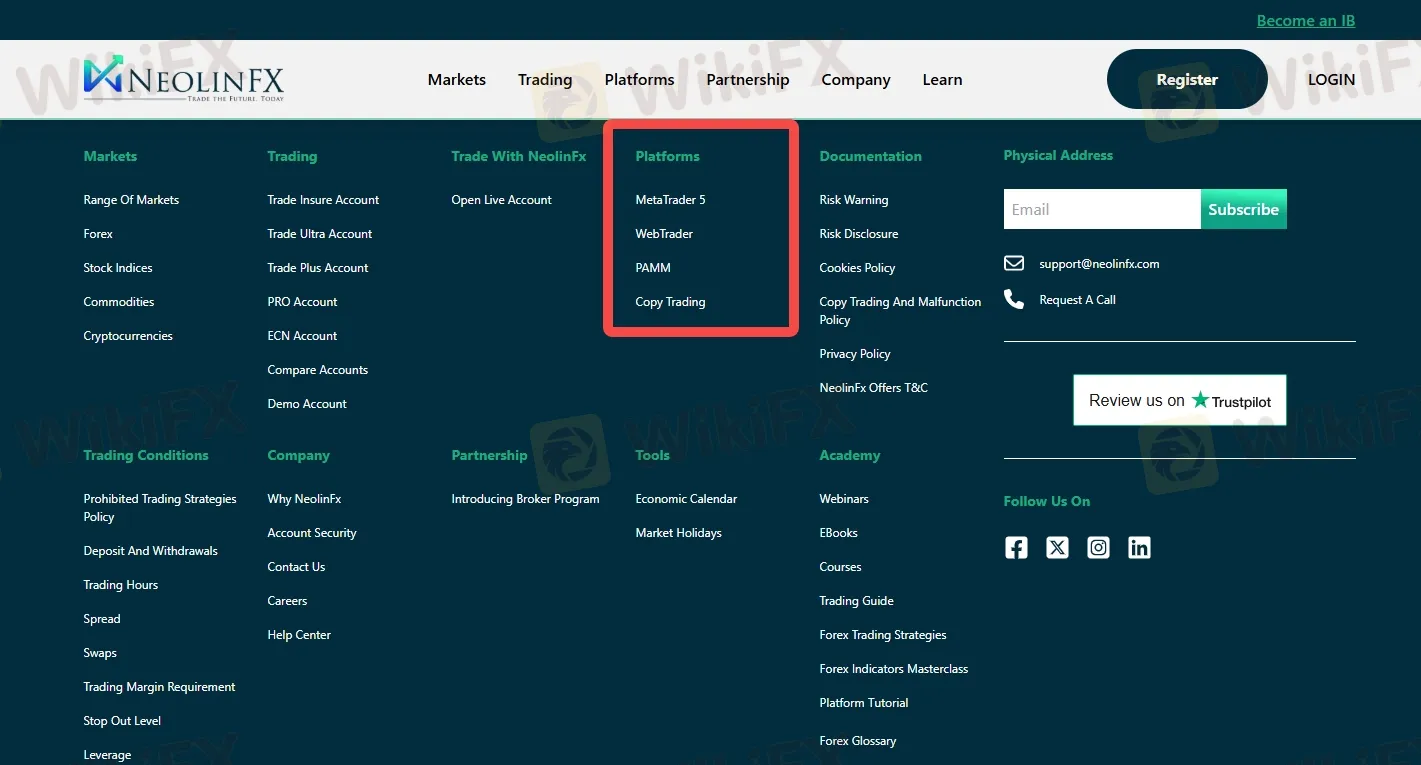

NeolinFX offers the MetaTrader 5 (MT5) platform, which is good but they do not offer MetaTrader 4 (MT4). This is strange because MT4 is the most popular trading platform in the world. Many traders, especially beginners, prefer MT4 because its easy to use and has many useful tools. Not offering MT4 means traders have fewer choices, and it may be harder for them to trade the way they want.

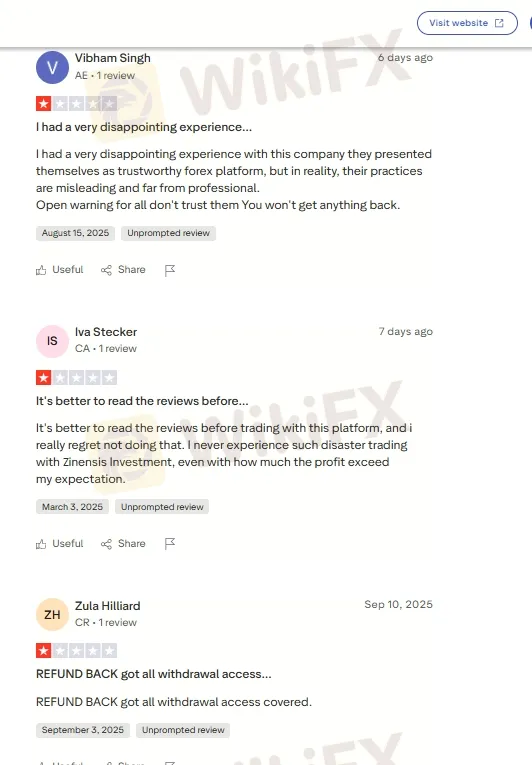

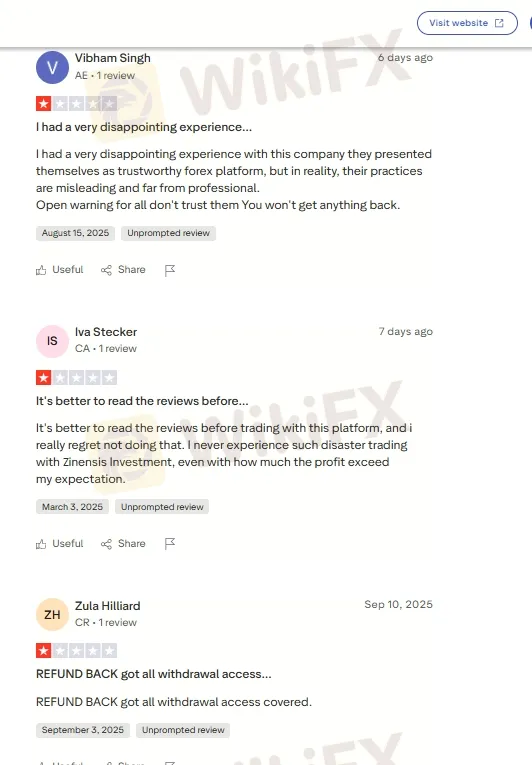

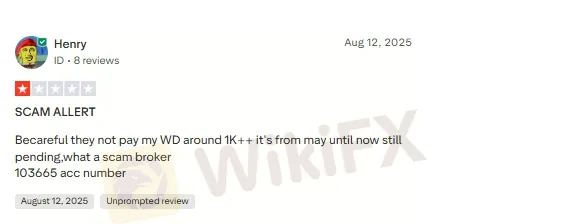

4. Many Negative Reviews

When we looked into NeolinFX, we found many negative reviews from real users. People have complained about bad customer service, delayed withdrawals, and unfair practices. Some even called the broker a scam. These are serious complaints, and they should not be ignored. When many traders say the same bad things, it usually means there is a real problem.

Conclusion

NeolinFX shows too many red flags no strong regulation, no physical office, no MT4, and lots of unhappy users. It‘s better to stay safe and choose a broker that is licensed, open about their location, and trusted by many traders. Don’t take risks with your money do your research and pick a broker you can trust.

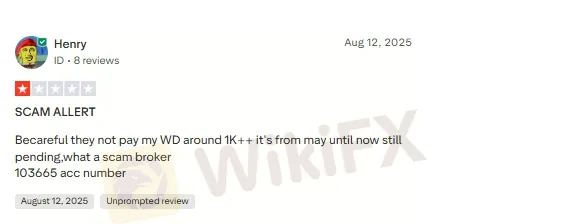

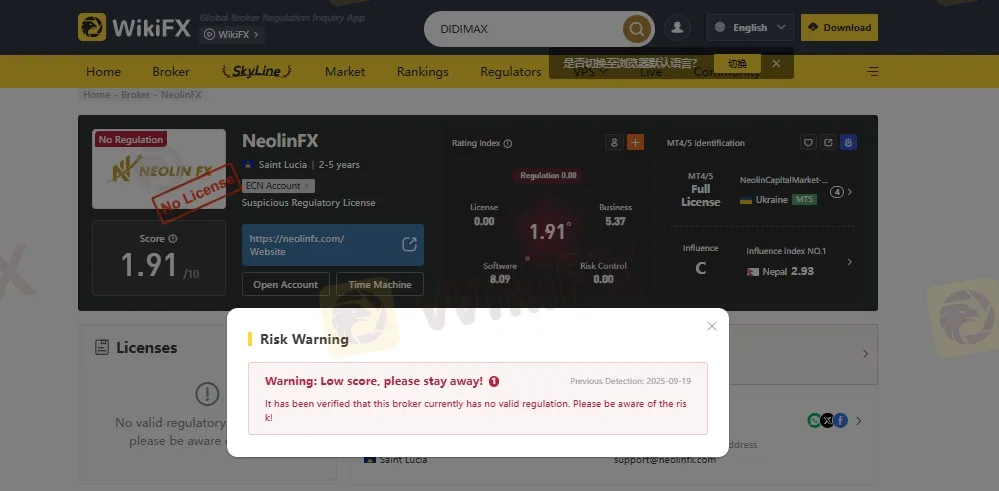

What Does WikiFX Say About NeolinFX?

When we checked NeolinFX on WikiFX, a well-known platform that rates and reviews forex brokers, the results were concerning. NeolinFX received a very low score of just 1.91 out of 10, which clearly shows that it is not considered a reliable or trustworthy broker by industry standards.

WikiFX has issued a major warning about this broker. The platform clearly states: “Warning: Low score, please stay away!” This kind of alert from a trusted third-party source should not be ignored. It strongly suggests that NeolinFX may not be safe for traders and could be involved in risky or unprofessional practices.

If you're thinking about trading with NeolinFX, this warning is a big red flag and a good reason to look for a more reputable, regulated broker.

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!