Abstract:KQ Markets (kqmarkets.co.uk) says it is a UK broker regulated by the FCA, but some users have reported problems that many people don’t notice until it’s too late. Here are some Hidden issues:

KQ Markets (kqmarkets.co.uk) says it is a UK broker regulated by the FCA, but some users have reported problems that many people don‘t notice until it’s too late.

Here are some Hidden issues:

1. Regulatory Ambiguity and Complaints- Some reviews and watchdogs claim KQ Markets is not licensed in all the jurisdictions it says its operating in. For example, ForexDepositBonuses asserts that KQ Markets is unlicensed in certain areas and warns users that their money is “not safe.” There are user reports that withdrawals are blocked, delayed, or made difficult. People say excuses are given, or extra money asked, for verification.

2. Hidden Fee Structure- Several users say that the spreads (the difference between buy and sell price) are widened during volatile market times or “slippage” is large. This means costs may be higher than what is advertised. The leverage details (how much you can borrow relative to your deposit) are not clear in many promotions. For many brokers, high leverage is risky. KQ doesnt always clearly show the leverage conditions for all account types.

3. Withdrawal Difficulties - A repeated complaint is that after making profits, when clients try to withdraw money, KQ Markets allegedly delays the process.

In some cases, users say they were asked to pay further fees or “top up” verification amounts before they could receive their funds. These extra demands sometimes appear unexpected.

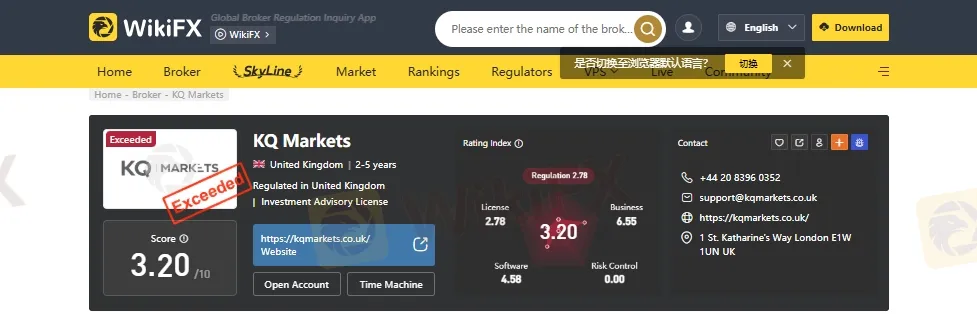

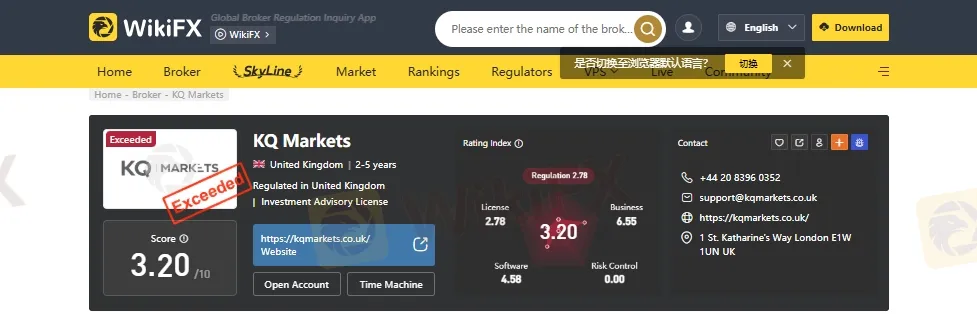

What WikiFX Reveals About KQ Markets

According to WikiFX, KQ Markets has received a poor trust score of just 3.20 out of 10, indicating serious concerns about the brokers credibility and overall reliability. WikiFX has also issued an explicit warning against using the platform, stating: “Warning: Low score, please stay away!”

For traders seeking a secure and trustworthy trading environment, such a low score should serve as a major red flag and a strong reason to reconsider opening an account with KQ Markets.

Conclusion

KQ Markets may offer many attractive features. But the hidden downsides are significant: withdrawal issues, unclear fees, risk of impersonators or clones, and potential regulatory weaknesses. Anyone considering trading with KQ should proceed with caution, do independent verification, and treat the “fine print” with respect.

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!