简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FOMC Meeting Adds Uncertainty, Market Volatility Intensifies

Abstract:A recent U.S. appeals court ruling rejected the Trump administrations attempt to remove Federal Reserve Governor Lisa D. Cook, confirming that she will remain eligible to participate in the September

A recent U.S. appeals court ruling rejected the Trump administrations attempt to remove Federal Reserve Governor Lisa D. Cook, confirming that she will remain eligible to participate in the September FOMC meeting. The independence of central banks is critical. From a historical perspective, when markets perceive political interference in monetary policy, the short-term impact may seem supportive, but the long-term consequences are overwhelmingly negative.

Stimulating growth at the expense of price stability risks creating crises that take years to repair—as seen during the “Great Inflation” of the late 1960s and 1970s, when interest rates swung sharply up and down.

Trump‘s criticism of Governor Cook is not rooted in her being overly hawkish. Rather, Cook was appointed by President Biden in 2022 and re-nominated in 2025. Trump has frequently tied “Biden’s team” to high inflation in his campaign narrative, making Biden-appointed Fed governors easy political targets.

Following the court ruling, gold initially spiked to $3,689.34/oz before retreating below its opening level of $3,680/oz, as investors took comfort in the Feds independence remaining intact, at least for now.

Consumer Sentiment Data

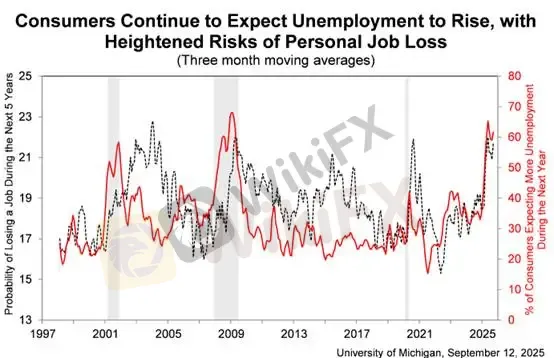

The University of Michigans recent consumer sentiment survey highlights rising concerns about unemployment. As shown in the chart below, during the 2001 tech bubble, the 2008 financial crisis, and the 2020 pandemic, both aggregate and personal unemployment risk expectations surged sharply. Currently, more than 60% of consumers expect joblessness to rise—one of the highest readings since 2009.

(Figure 1. Consumer expectations of future unemployment and personal job-loss risk; Source: University of Michigan)

Despite equity markets trending higher, consumers remain pessimistic about the real economy. The Consumer Sentiment Index declined from 58.2 in August to 55.4. The Expectations Index fell to 51.8 from 74.4 a year ago, down 7.3% month-over-month. This indicates not only negative views about current conditions but also worsening expectations for future income and the broader economy.

Notably, confidence among middle-income households deteriorated more sharply, suggesting spending on mid-range and essential goods could be squeezed earlier and more severely. As we have previously noted, front-loading purchases and pulling demand forward remain widespread, while households increasingly favor saving or cutting discretionary spending. Rate cuts alone are unlikely to provide an immediate boost. Declining sentiment typically precedes actual weakness in spending and economic data, and sustained pessimism could amplify volatility across financial markets—particularly weighing on consumer goods, retail, and durable-goods stocks.

The divergence between real-economy fundamentals and risk-asset valuations reinforces our earlier view: equity markets remain overvalued and inflated.

Gold Technical Analysis

On the technical front, gold exhibited a “spike-and-fade” pattern in Asian trading, with hourly candlesticks forming a bearish engulfing reversal. Combined with short-term MACD divergence, the probability of a corrective pullback has increased. Traders may consider short positions, with stops set above the intraday high.

Key levels to watch:

Support: $3,655 / $3,620

Resistance: $3,687

The repeated divergences highlight weakening upside momentum. The more frequent these divergences occur, the greater the likelihood of a deeper downside correction.

Risk Disclaimer: The views, analysis, research, prices, or other information provided herein are for general market commentary only and do not represent the position of this platform. Readers should bear all risks independently. Please trade with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

INTERPOL, AFRIPOL Crack Down on Africa Terror Finance

Forex Scam Checker Philippines: Verify Brokers with WikiFX

MH Markets Review 2025: Trading Platforms, Pros and Cons

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

D Prime to Exit Limassol Office Amid Doo Group Restructure

WikiFX Elites Club Committee Concludes Voting! Inaugural Lineup Officially Announced

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

eToro CopyTrader Expands to U.S. Investors

Is MH Markets Safe or a Scam? Regulation and Fund Security Explained

Currency Calculator