简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Holds Above 5-Day MA, But Bullish Momentum May Falter

Abstract:The market remains in a “celebration mode” centered on the Feds potential rate cuts, driving rallies across gold, long-term Treasuries, and equities. However, we remain concerned that weakness in the

The market remains in a “celebration mode” centered on the Feds potential rate cuts, driving rallies across gold, long-term Treasuries, and equities. However, we remain concerned that weakness in the U.S. labor market and sluggish domestic demand could eventually trigger a correction following the recent surge. When that happens, the familiar “cash is king” dynamic—marked by selloffs in stocks, bonds, and gold—may reemerge. Investors should stay level-headed and avoid chasing gains fueled by FOMO.

Jobless Claims: A Leading Indicator

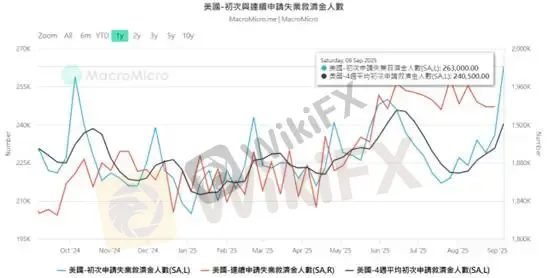

Initial jobless claims serve as a forward-looking gauge of the labor market. This weeks report showed 263,000 claims, the highest in four years. The four-week moving average confirms a structural turning point.

(Chart 1: Initial and Continuing Jobless Claims; Source: M Square)

The Feds Dual Mandate: Price Stability and Maximum Employment

Chair Powells dovish tone in August highlighted a labor market slowdown and weak domestic demand, making it difficult to maintain a hawkish stance. His position has faced criticism from both Besant and Trump, who accused him of failing his mandate.

Is Inflation Under Control?

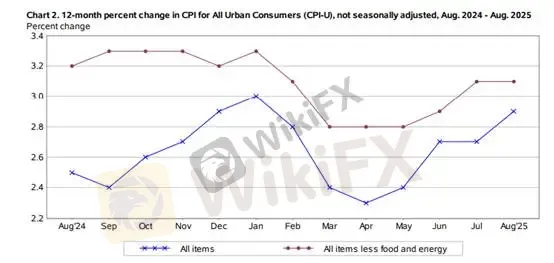

The latest CPI data showed headline inflation at 2.9%, above the prior reading, and trending higher since bottoming in April. While this suggests persistent inflation, the situation is less alarming than it appears. Core CPI held steady at 3.1%, indicating there is no deflation risk at present.

(Chart 2: CPI vs. Core CPI; Source: M Square)

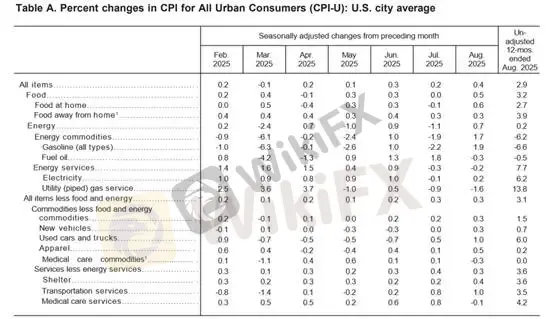

Breaking down the report, energy contributed positively with a 0.2% year-over-year gain, mainly due to seasonal increases in natural gas prices. Fortunately, crude oil prices remain in a downward trend, with OPEC+ reaffirming its production hike plan. Given gasoline‘s low elasticity, this seasonal uptick should not derail the Fed’s easing path.

(Chart 3: CPI Components; Source: BLS)

This raises a key policy question: Are price increases being driven by inelastic goods (necessities) or elastic goods (discretionary items)?

If inelastic goods drive inflation, disposable income shrinks, reducing demand for discretionary spending—a signal of consumer retrenchment.

If inflation stems from elastic goods while essentials remain cheap, disposable income stays intact, and consumer activity can remain robust.

Consumer Sentiment and Wealth Effect

Disposable income and wealth effects—via stock market or real estate gains—shape consumption behavior. The University of Michigans consumer sentiment report, due tonight, will provide a forward-looking gauge. Last month, sentiment remained subdued, with 58% of households planning to cut spending in response to inflation. While equity gains have boosted paper wealth, they have yet to shift consumer expectations for future spending.

Technical Analysis

Gold has traded sideways for three consecutive sessions, holding firmly above its 5-day moving average, preserving a strong bullish structure.

Short positions: maintain exposure and wait for exit levels.

Flat positions: remain on the sidelines, avoid chasing longs.

Structurally, $3,650 is the key pivot. A confirmed break above could trigger renewed upside momentum, but traders should beware of short-term breakout risks. Intraday bias remains toward range-bound trading.

Key Levels

Support: $3,636

Resistance: $3,650 / $3,673

Risk Disclaimer: The above views, analysis, research, prices, or other information are provided as general market commentary and do not constitute investment advice. All readers assume full responsibility for their trading decisions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

WikiFX Elites Club Committee Concludes Voting! Inaugural Lineup Officially Announced

eToro CopyTrader Expands to U.S. Investors

Is MH Markets Safe or a Scam? Regulation and Fund Security Explained

Ponzi Scheme Operator Sentenced to 14 Years in Western Australia

Chicago PMI Beats But Remains In 'Contraction' For Second Straught Year

How to Add and Take Out Money from Amillex Broker: A Complete Guide

T4Trade broker Review 2025: Is T4Trade Regulated?

FCA warning: These Firms are on the list

Don’t Get Scammed: A Roundup of Common Online Fraud Tactics in Forex

Currency Calculator