Abstract:If you’re trading from Malaysia and still jumping between ten random currency pairs, you might be leaving money on the table. The truth is, not all forex pairs are created equal. Some offer deep liquidity, tighter spreads, and perfect trading windows that match Malaysian time zones, while others drain your account with hidden costs and poor execution. Professional traders already know which pairs dominate the market here, and if you’re not trading them, you could be missing out on the very moves that drive consistent profits.

If you‘re trading from Malaysia and still jumping between ten random currency pairs, you might be leaving money on the table. The truth is, not all forex pairs are created equal. Some offer deep liquidity, tighter spreads, and perfect trading windows that match Malaysian time zones, while others drain your account with hidden costs and poor execution. Professional traders already know which pairs dominate the market here, and if you’re not trading them, you could be missing out on the very moves that drive consistent profits. Before you place your next trade, discover the top currency pairs that Malaysian traders rely on and learn how WikiFX can help you avoid costly mistakes by verifying which brokers truly deliver on these pairs.

EUR/USD

EUR/USD is the most traded currency pair in the world and naturally one of the favourites among Malaysian traders. It is highly liquid, which means order execution is fast and spreads are among the tightest available across most regulated brokers. This pair also tends to behave in a more predictable, trend-driven manner compared to thinner markets, which makes it attractive for both new and experienced traders. In terms of timing, EUR/USD is most active from 3:00 pm to around midnight Malaysian time, covering the London and early New York sessions. Traders should, however, remain cautious during major economic data releases such as U.S. Non-Farm Payrolls or Eurozone CPI, as these events can trigger sharp price spikes.

GBP/USD

GBP/USD, often called “Cable,” is another favourite in Malaysia because of its strong intraday price movements. Unlike EUR/USD, which often trends more steadily, GBP/USD is known for its larger swings and higher volatility, which creates plenty of opportunities for short-term traders. The most active period for GBP/USD also falls conveniently in the evening hours in Malaysia, typically from 3:00 pm until 1:00 am, overlapping with the London and New York trading sessions. While its volatility can be attractive, traders should manage their position sizes carefully, as sudden moves during political or economic announcements from the U.K. can catch traders off guard.

USD/JPY

USD/JPY stands out as a strong option for Malaysians who prefer to trade during Asian business hours. The pair tends to be active between 8:00 am and 12:00 pm Malaysian time during the Tokyo session, and it comes alive again during the evening when London and New York overlap. Many traders appreciate USD/JPY because its price action often follows clear macroeconomic themes, particularly interest rate differentials between the Federal Reserve and the Bank of Japan. However, traders should be alert to sudden moves triggered by Bank of Japan announcements or policy surprises, which can shift the market rapidly.

AUD/USD

For traders who want action early in the day, AUD/USD is a natural choice. This pair is at its most active from around 5:00 am to 1:00 pm Malaysian time, during the Sydney and Tokyo sessions, making it perfect for those who want to trade in the morning before European markets open. AUD/USD is also strongly influenced by commodity prices, Chinese economic data, and Reserve Bank of Australia (RBA) policy decisions, which means it often reflects broader risk sentiment across Asia-Pacific markets. While this creates opportunities for trend-followers, it also means that the pair can be sensitive to sudden news out of China or unexpected RBA decisions.

GBP/JPY

GBP/JPY is a pair that attracts Malaysian traders who thrive on volatility and big intraday swings. Often nicknamed “the Beast,” this cross combines the fast-moving nature of GBP with the sharp, liquidity-driven moves of JPY. The result is a pair that can cover hundreds of pips in a single session, offering plenty of opportunities for active traders. GBP/JPY tends to be most liquid during the London-to-New York overlap, from around 3:00 pm to midnight Malaysian time, although it also reacts strongly to developments in the Asian session when Japanese data or Bank of Japan policy headlines hit the wires. The main risk with this pair is its unpredictability: sharp reversals are common, and traders without proper risk management can quickly be caught on the wrong side of a move. This is why many Malaysians use GBP/JPY selectively for short-term trading setups rather than long-term positions.

What About USD/MYR?

It may be tempting to trade your home currency, but USD/MYR is not an ideal pair for most retail traders. Liquidity is much thinner, spreads are wider, and Malaysia maintains onshore restrictions that limit offshore trading activity. Many reputable brokers either do not list USD/MYR or only provide it under limited terms. For this reason, it is usually more cost-effective and practical to focus on the major pairs mentioned above.

Trading Sessions in Malaysia (MYT, UTC+8)

Knowing when to trade is as important as choosing the right pair. The Sydney session runs from around 5:00 am to 2:00 pm Malaysian time, followed by the Tokyo session from 8:00 am to 3:00 pm. London markets open at 3:00 or 4:00 pm, depending on daylight savings, and remain active until around midnight. Finally, New York overlaps from around 8:00 or 9:00 pm until early morning. For Malaysian traders, the most active and liquid windows are the London-to-New York overlap in the evenings, which is excellent for EUR/USD, GBP/USD, GBP/JPY, and USD/JPY, and the Sydney-to-Tokyo hours in the morning, which favour AUD/USD, and USD/JPY.

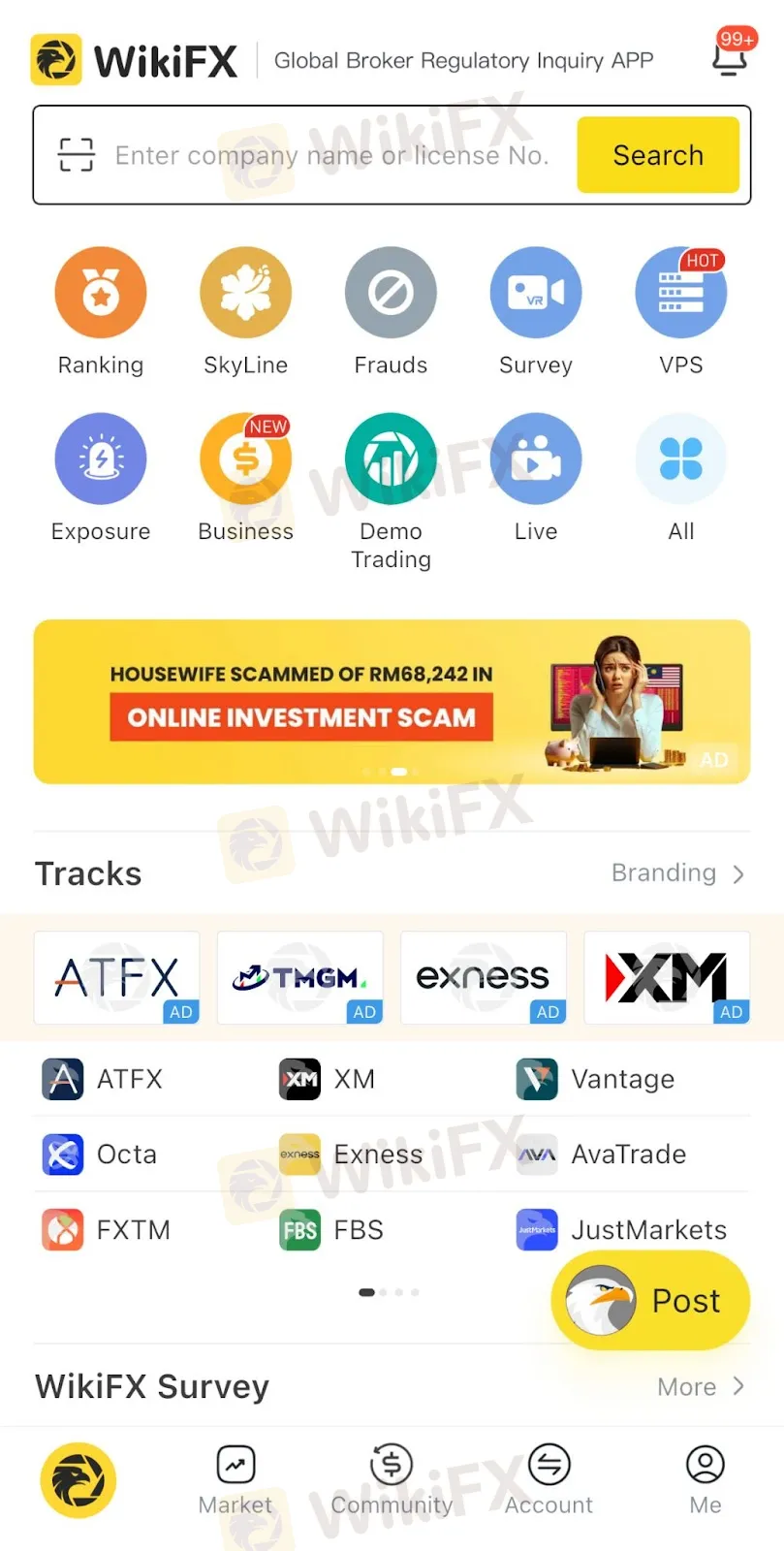

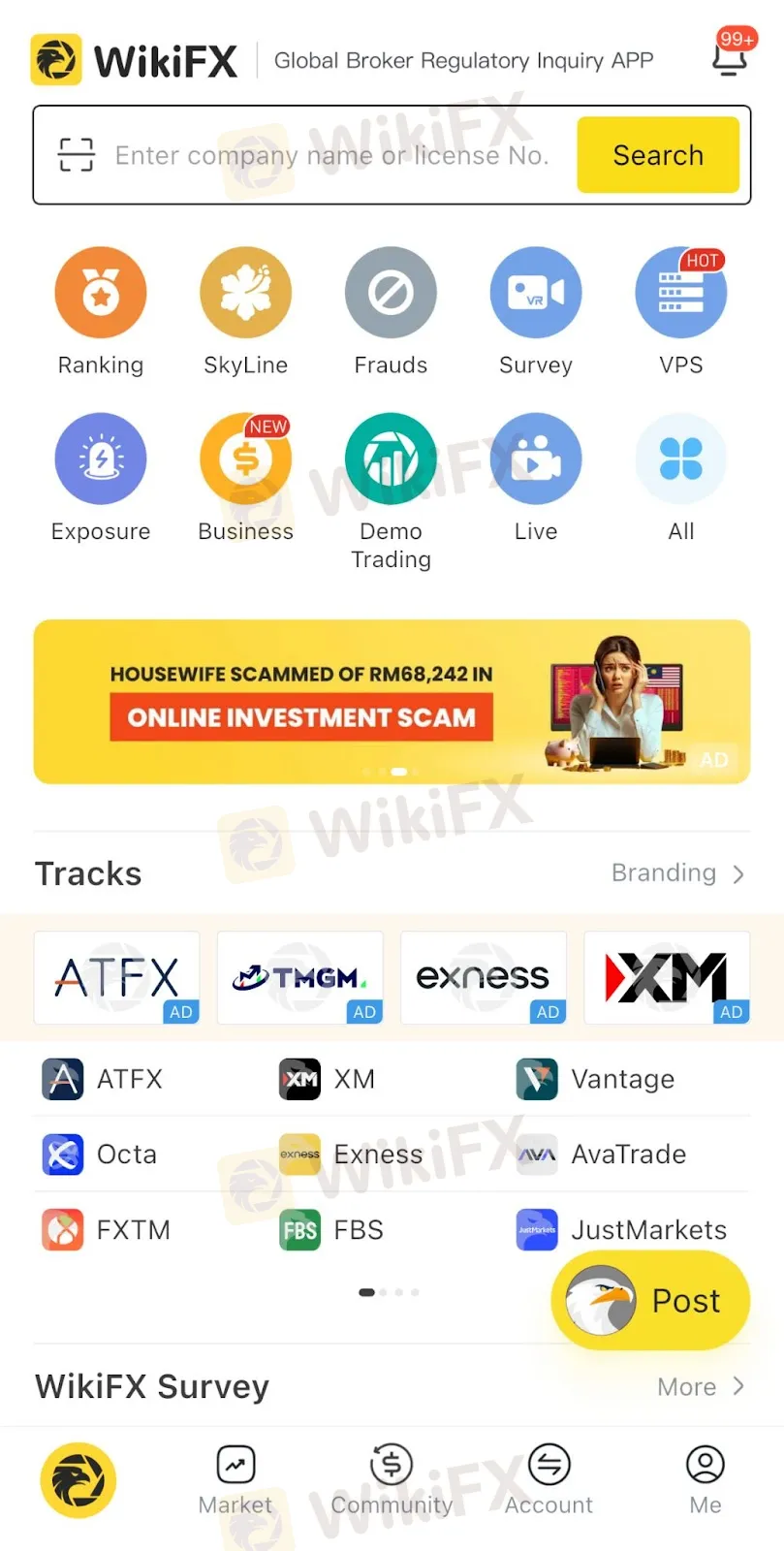

Using WikiFX to Trade Smarter

Choosing the right pairs is only half the battle as execution, cost and broker integrity decide the rest. WikiFX consolidates the facts Malaysian traders need into one place: verified regulator and license checks, aggregated real-world spreads, commissions and overnight swap data, user-reported execution and slippage feedback, complaint histories, product availability (including region-specific pairs) and practical details like funding options, withdrawal timelines and support hours that align with MYT. Use WikiFX to compare brokers side-by-side, shortlist 2–3 regulated brokers, and validate live spreads and execution in a demo before risking capital and doing that simple due diligence removes hidden frictions so your strategy, not your broker, determines results. Don't trade blind: let WikiFX be the final check before you hit “Buy” or “Sell.”