Abstract:Seeking a successful run in forex trading? You need to master the forex price action strategy. Many of your fellow traders are using it to continue earning profits in a volatile market environment. Price action in trading analyzes the performance of a currency pair and provides hints about its potential future direction. If you find that the currency pair price is likely to surge in your price action analysis, taking a long position is advised. If it suggests a price fall, consider taking a short position.

Seeking a successful run in forex trading? You need to master the forex price action strategy. Many of your fellow traders are using it to continue earning profits in a volatile market environment. Price action in trading analyzes the performance of a currency pair and provides hints about its potential future direction. If you find that the currency pair price is likely to surge in your price action analysis, taking a long position is advised. If it suggests a price fall, consider taking a short position.

Forex price action trading looks at price pattern charts and identifies key indicators with a potential impact on your investments. Successful traders use a wide range of forex price action strategies to estimate price movements and enjoy gains on their trades.

List of Forex Price Action Strategies

Price Action Trend Trading

Price action trend trading involves studying emerging trends. Traders can leverage a wide range of trading techniques to identify and follow price action trends, including the head and shoulders trade reversal. New traders can use this forex trading strategy to chase visible price action trends. The green uptrends shown on the infographic below indicate opening a buy position. On the other hand, the red downward trends hint at selling the asset.

Image Courtesy - IG

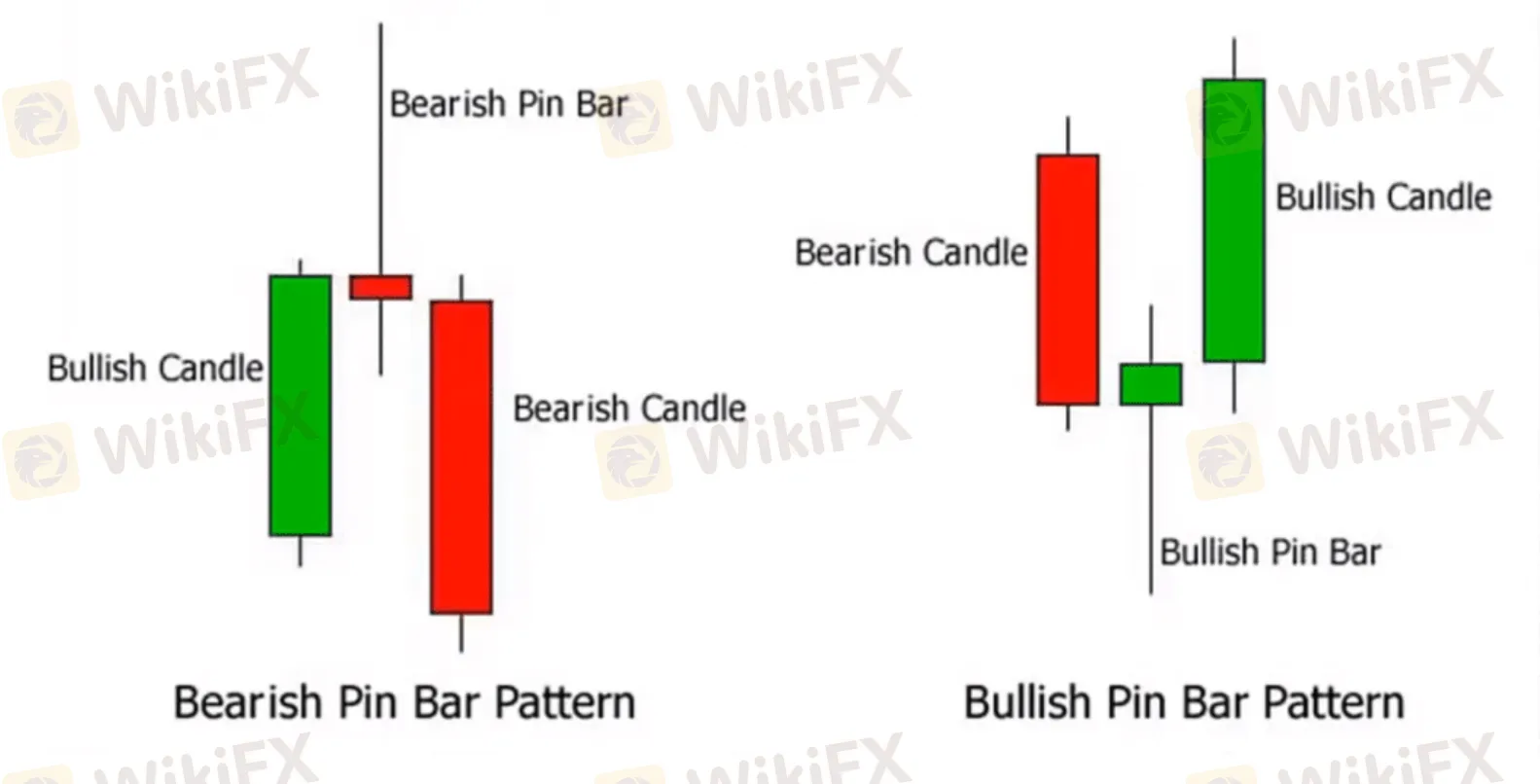

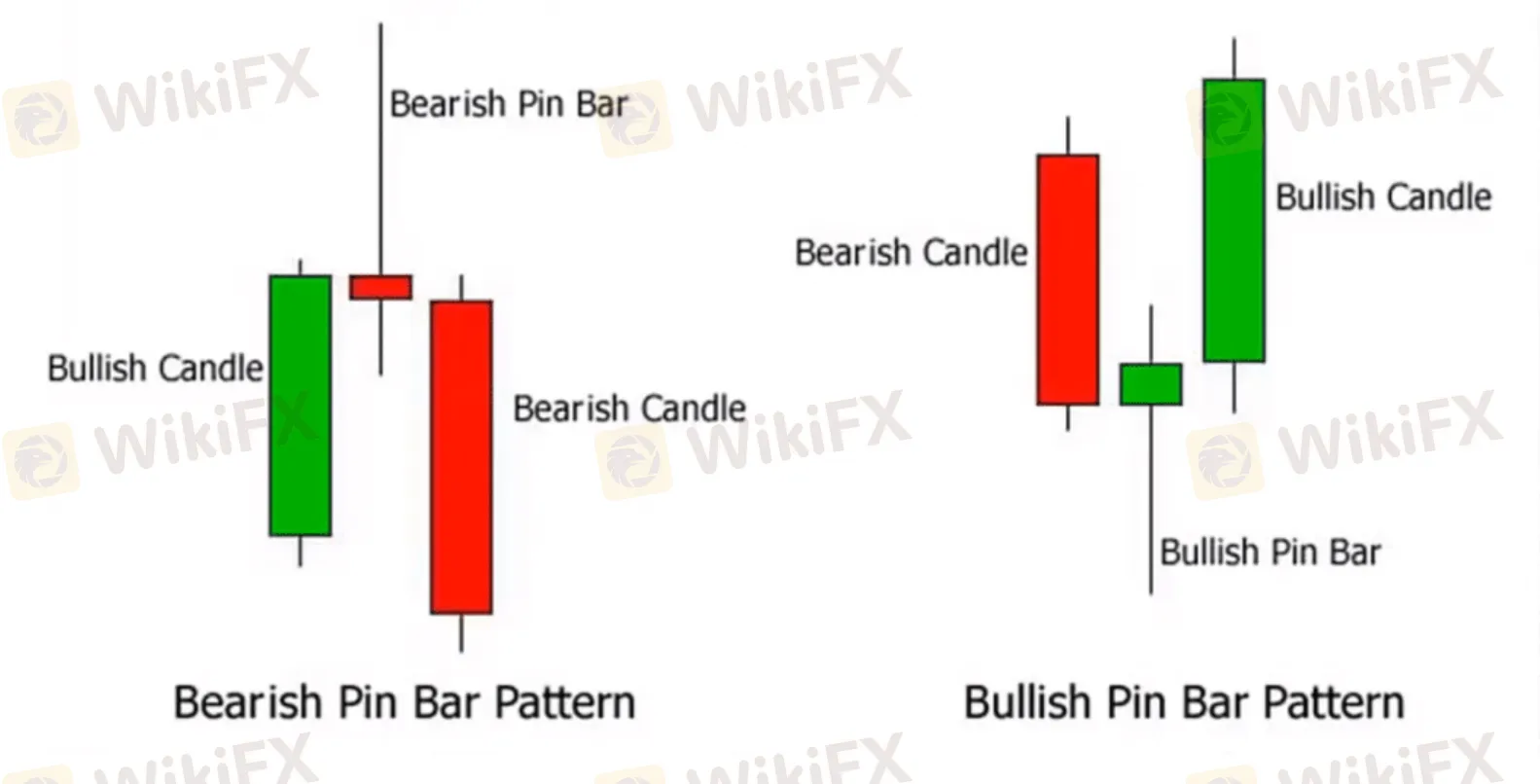

Pin Bar

The pin par pattern seems like a candle with a long wick on it, and is often known as the candlestick strategy, owing to its distinctive shape. The candle is an indicator of a sharp price reversal and rejection. On the other hand, the wick or tail showcases the rejected price range. This strategy works on the assumption that the price is expected to reverse and move in the opposite direction of the tail. Traders can use this insight to choose between long and short positions in the forex market. For instance, if the pin bar pattern features a long lower tail, it shows a trend of lower price rejections. It indicates a potential price rise.

Image Courtesy - TradingwithRayner

Inside Bar

This forex price action strategy involves two bars where the inner bar remains smaller than the outer bar. The smaller bar remains within the high and low range of the outer bar. Inside bars usually emerge during the market consolidation phase. However, they can also be a red herring, indicating a potential market turnaround. Skilled traders can identify this trend to figure out a potential consolidation or a change in the ongoing trend. The position and size of the inside bar help determine the price movement (up or down).

Image Courtesy - Forex Training Group

Trend Following Retracement Entry

In this forex price action strategy, the trader follows the ongoing trend. If the price has clearly moved downwards consisting of consistently lower highs, the trader is advised to take a short position. In the case of an incremental price hike with increased highs and lows, the trader should buy.

Image Courtesy - IG

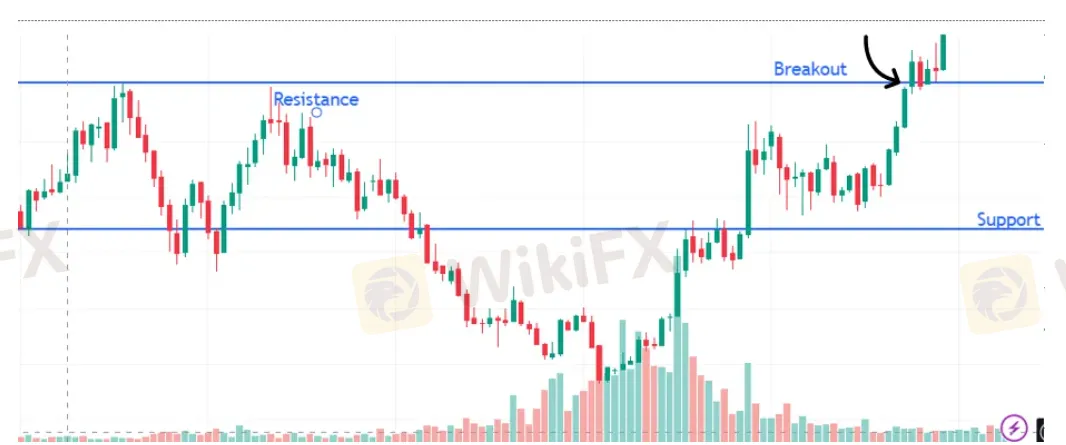

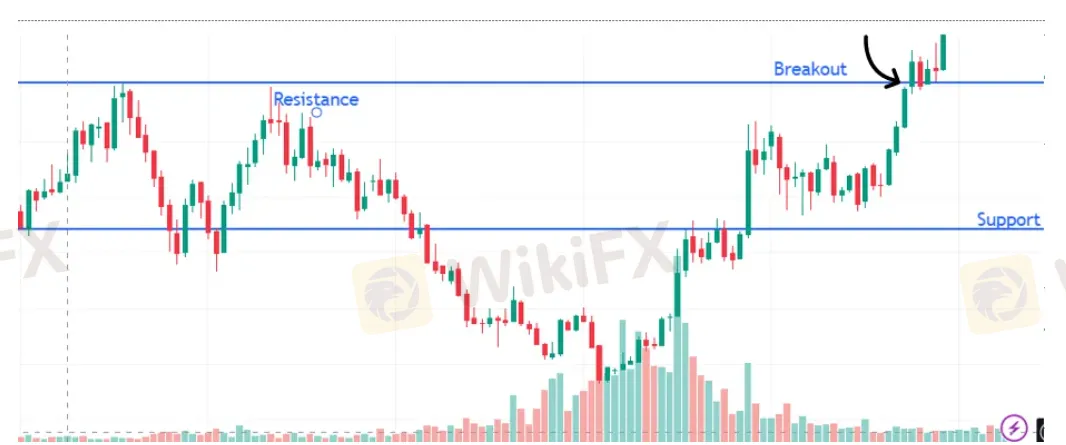

Trend Following Breakout Entry

This trend helps monitor major market movements based on the assumption that a retracement will happen after a price spike. A breakout occurs as the forex market goes beyond a defined support or resistance level. Traders can use this to take a long position if the price of the currency pair continues to move up or breaches the resistance level, or a short position if the price movement has been below the support level.

Image Courtesy - Wright Research

Head and Shoulders Reversal Trade

The head and shoulders forex price pattern indicates a market movement that appears slightly as the silhouette of a head and shoulders. Simply put, prices surge, decline, surge even more, decline again, and surge to a lower high before registering a slight fall in this trend. This forex price action strategy finds massive adoption by traders as they easily select an entry point ((usually remains after the first shoulder) and set a stop-loss order (after the second shoulder) to benefit from a temporary peak.

Image Courtesy - IG

Forex Price Action Involving High and Low Sequences

Forex price action trading features highs and lows based on the prevailing market sentiment. Traders can carefully analyze the sequence involving price highs and lows to figure out emerging market trends. For instance, if the currency pair trades at upper highs and upper lows, it means an upward trend. The downward trend emerges when the currency pair trades at lower highs and lows. Traders can use this sequence to select a lower entry point of an upward trend and set a stop-loss order prior to the previous higher low.

Wrapping Up

Implementing forex price action strategies is critical to navigating the challenging market environment. As a trader, the more these strategies you employ, the more your market understanding develops. The price trends, patterns, and indicators help you channelize your forex investments effectively. Both experienced and novice forex traders can capitalize after evaluating the head and shoulders pattern, pin bars, inside bars, or other trends. Informed decision-making on forex trading is the byproduct of effective technical analysis involving these charts.

WikiFX Masterminds is Live Now!

Join it with these few steps.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations, you are part of the community.