Abstract:Currency pairs play a crucial role in forex trading. To effectively participate in the forex market, it's important to understand which currency pairs are most relevant in your country. For traders in India, knowing the actively traded currency pairs is essential.

Currency pairs play a crucial role in forex trading. To effectively participate in the forex market, it's important to understand which currency pairs are most relevant in your country. For traders in India, knowing the actively traded currency pairs is essential. In the Indian forex market, the most commonly traded pairs are those that include the Indian Rupee (INR).

Why INR-Based Currency Pairs Are Popular in India?

Due to regulations by the Reserve Bank of India (RBI) and oversight by SEBI, Indian traders primarily deal in INR-based pairs on domestic exchanges like the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Trading major international pairs like EUR/USD or GBP/USD is restricted to authorized platforms, which makes INR-based pairs the default choice for most Indian retail forex traders.

Most Popular Currencies include INR-

1. USD/INR – The Most Popular Currency Pair

The USD/INR pair is by far the most traded currency pair in India. This is primarily because the U.S. dollar is the world‘s dominant reserve currency, and a large portion of India’s international trade is settled in dollars. Whether it's for imports, exports, or foreign investments, the USD/INR pair is central to Indias financial ecosystem.

2. EUR/INR – Euro to Indian Rupee

The EUR/INR pair ranks next among the top traded currency pairs in India. The Euro (EUR) represents the Eurozone, one of Indias key trading partners. Many traders choose EUR/INR for its liquidity and volatility, making it a valuable pair for both short- and long-term strategies.

3. GBP/INR – British Pound to Indian Rupee

The GBP/INR pair is another favorite among Indian forex traders. The British Pound (GBP) has historical ties with India and remains a major global currency. Its relatively higher volatility can offer profitable trading opportunities for experienced traders in the Indian market.

4. JPY/INR – Japanese Yen to Indian Rupee

The JPY/INR pair is also actively traded, especially by those looking to diversify their portfolio. Japan is a significant economic partner of India, and movements in this pair are closely linked to economic indicators and trade relations between the two countries.

Checkout this Article - www.wikifx.com/en/newsdetail/202507308564185490.html

Other Top Pairs include:

1. EUR/USD (Euro/US Dollar): The most widely traded currency pair globally, reflecting the strength of the two largest economies.

2. USD/JPY (US Dollar/Japanese Yen): Popular for its high liquidity and relatively stable price movements.

3.GBP/USD (British Pound/US Dollar): Known as “Cable,” this pair reacts to key economic indicators from both the UK and the US.

4.AUD/USD (Australian Dollar/US Dollar): Closely tied to commodity markets, as Australia is a major commodity exporter.

5. NZD/USD (New Zealand Dollar/US Dollar): Influenced largely by New Zealands agricultural exports and commodity price trends.

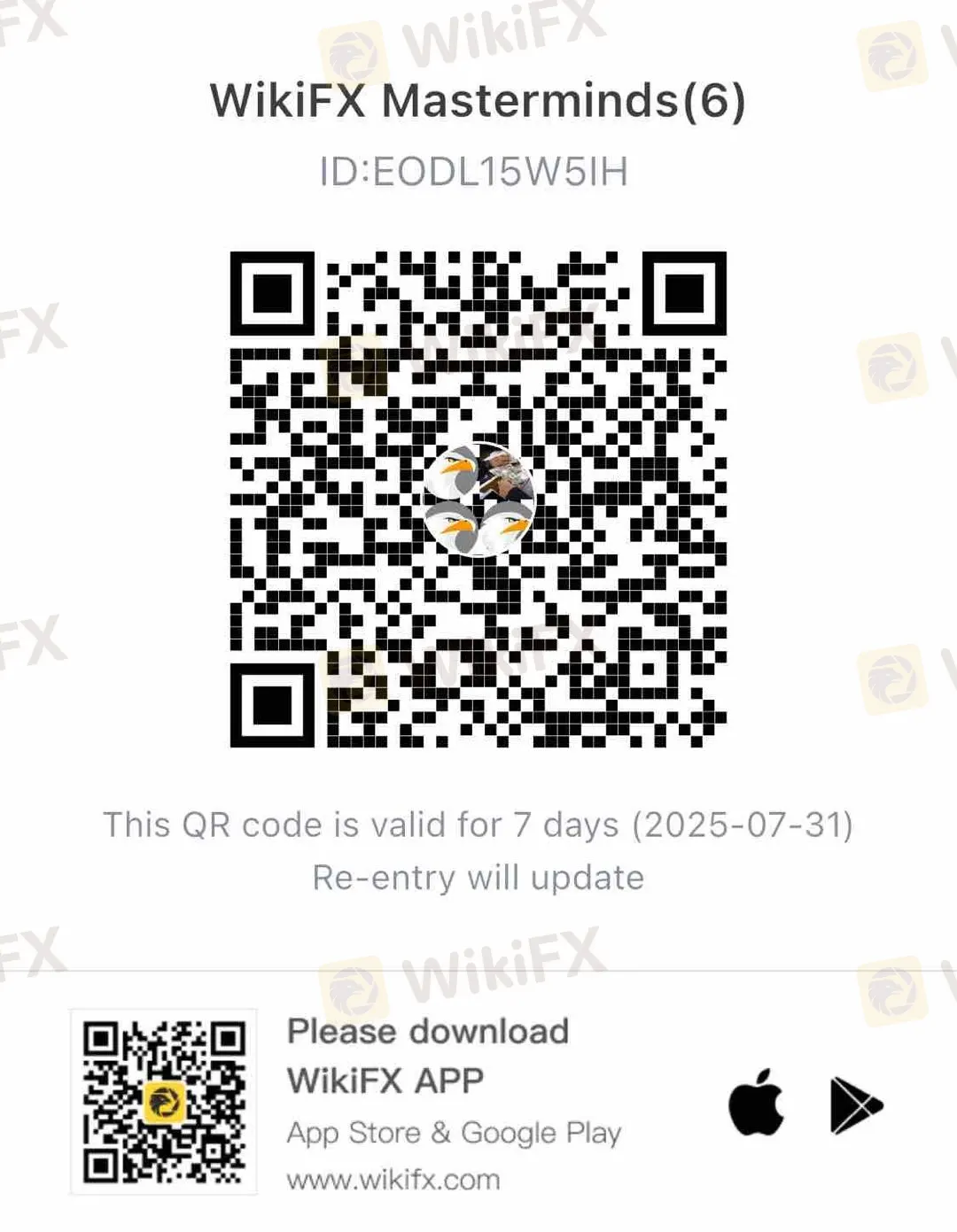

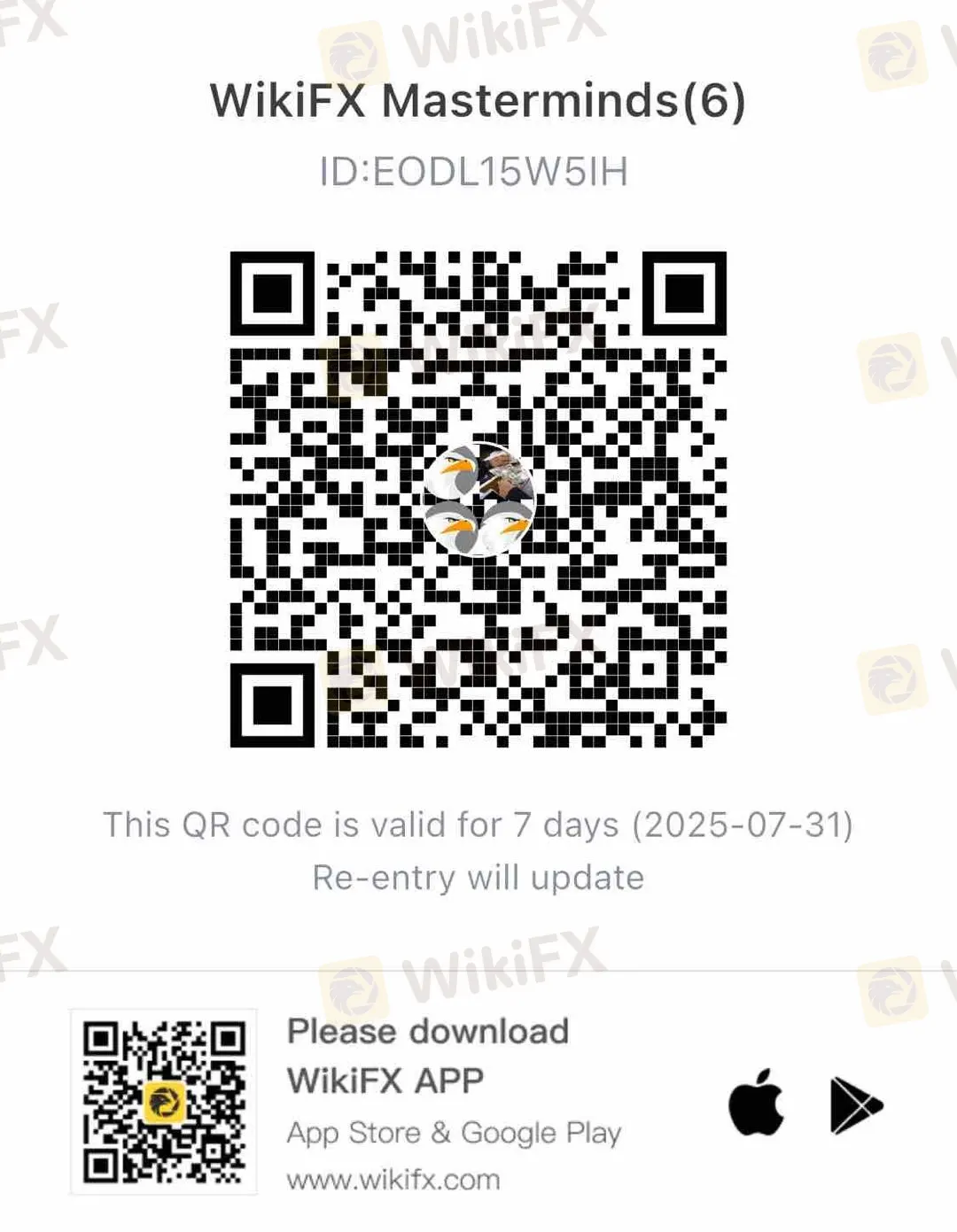

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!