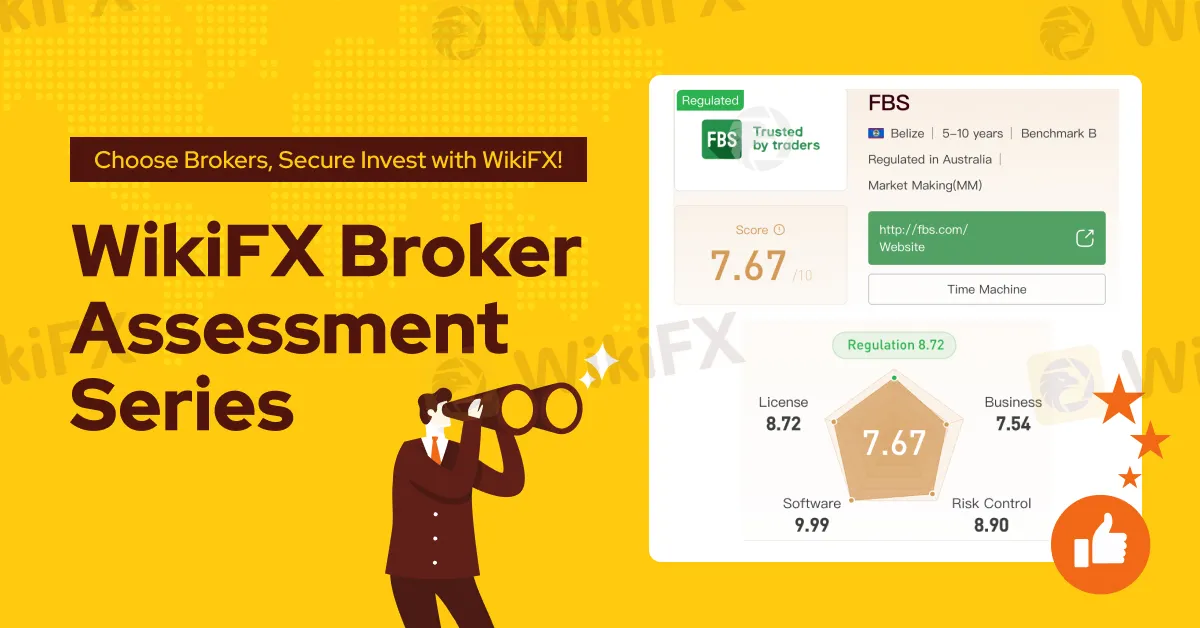

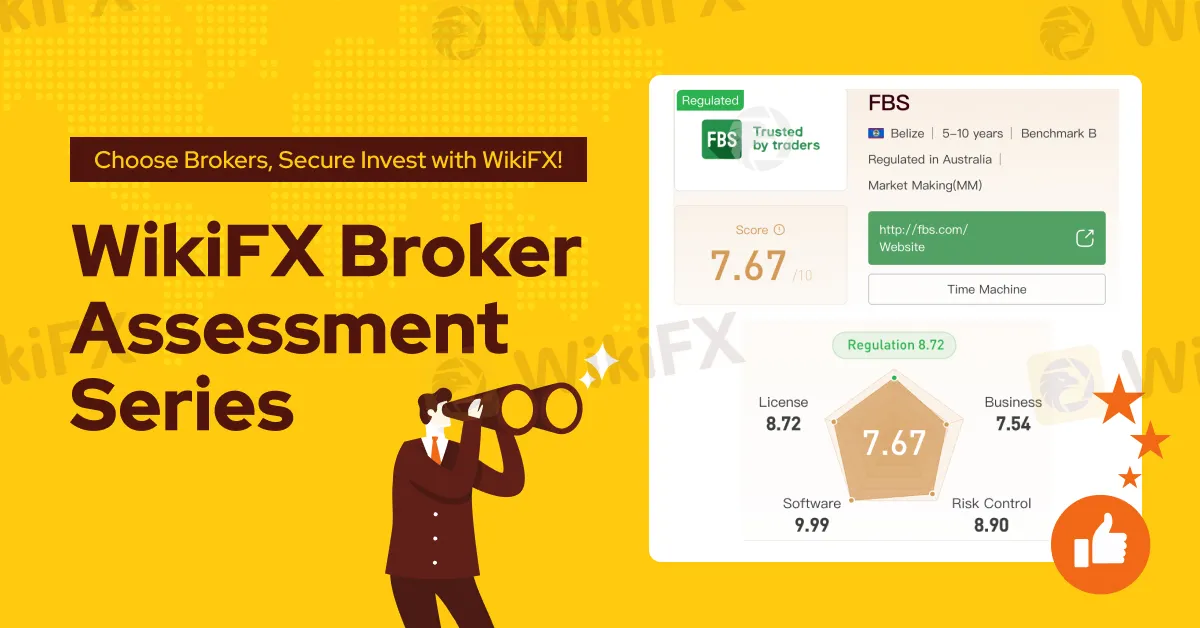

Abstract:This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

Basic Introduction

FBS is an internationally recognized broker with a significant presence in Asia, offering a variety of trading instruments such as forex, stocks, indices, energy, and metals. With over 90 international awards, FBS serves 27 million customers in 150 countries, earning a stellar reputation globally.

The company offers flexible trading conditions, floating spreads starting from 0.7 pips, commission-free trading, and fast execution speeds from 0.01 seconds. FBS ensures customer safety with negative balance protection and provides a user-friendly experience on familiar trading platforms.

Features

FBS offers negative balance protection, ensuring users are not exposed to the risk of losing more than their account balance due to market fluctuations. The platform also provides various trading tools to meet the needs of different traders, whether they are beginners or experienced investors. To further enhance the user experience, FBS offers 24/7 customer support, answering queries and providing assistance as needed.

Fees

FBS offers flexible trading conditions for traders, allowing up to 500 open positions, including 200 pending orders. The leverage is adaptable to suit traders with different risk preferences. The minimum deposit is just $5, making it accessible for beginners. The order volume ranges from small to large positions, accommodating various trade sizes.

Trading Platforms

FBS provides multiple platforms, including MetaTrader 4, MetaTrader 5, and the FBS App.

The FBS App offers a convenient tool for investors to analyze market trends using easy-to-use charts, manage orders, and access the market anytime, anywhere. Investors can start trading quickly with a simple registration process, streamlined verification, and easy deposit options. With just one click, investors can view account equity, margin, available margin, and floating P&L to assess trading opportunities.

No matter where they are, investors can access charts and customize them according to their needs. By utilizing more than 90 indicators, they can identify price trends and make informed trading decisions.

Product Range

FBS offers a range of core products, including forex and stocks, to meet the primary investment needs of most individual investors. These products provide flexible investment options suitable for different types of traders.

To learn more about the reliability of a particular broker, you can visit our website (https://www.WikiFX.com/en) or download the WikiFX app, which helps you find the most trustworthy brokers, ensuring safer and more reliable trading.