Abstract:A Malaysian ex-manager lost RM2 million to a fake crypto investment via the digzax.com platform after being lured by promises of high returns. Police urge caution against unregulated apps and social media offers.

A former company manager has fallen victim to a fraudulent investment scheme, losing nearly RM2 million in the process.

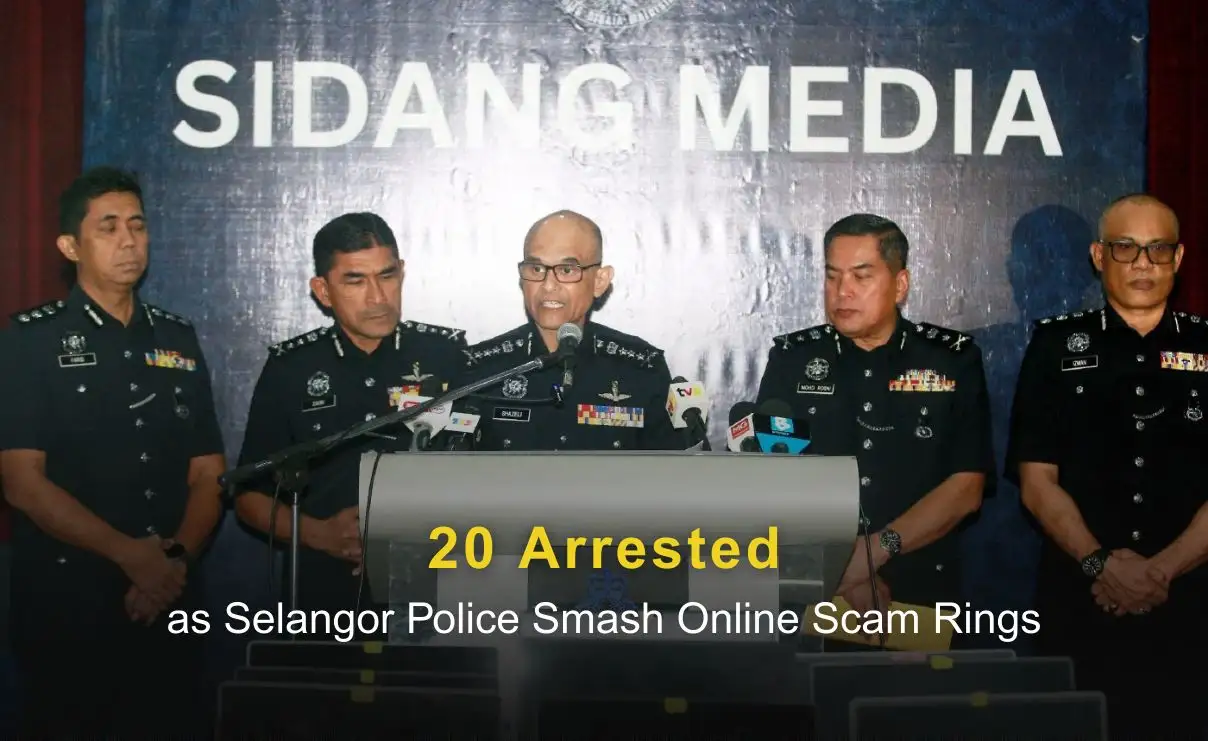

According to Selangor police chief Datuk Hussein Omar Khan, the 59-year-old Malaysian encountered a cryptocurrency investment advertisement on Facebook last October, which led him to join a WhatsApp group called “The Miracle of Stock Market.” The group introduced him to a seemingly lucrative investment opportunity on the platform digzax.com, promising profits of 30% to 70% within a short period.

Between October 29, 2024, and January 18, 2025, the victim made 41 transactions amounting to RM2,055,944 across 11 different bank accounts. Scammers assured him of a projected profit of RM46 million, which never materialized.

“When the victim attempted to withdraw his alleged profits, he was asked to make additional payments under various pretenses. This ultimately led to the realization that he had been scammed,” Hussein said. The case is now under investigation under Section 420 of the Penal Code for cheating and dishonestly inducing the delivery of property.

Hussein urged the public to exercise caution and avoid being swayed by investment offers on social media that promise unrealistic returns, particularly those involving unregulated mobile apps. He emphasized the importance of verifying financial platforms through reliable authorities such as Bank Negara Malaysia or the Securities Commission Malaysia.

As investment scams become increasingly prevalent, tools such as WikiFX can play a crucial role in safeguarding investors. WikiFX provides an extensive database of global brokers, complete with regulatory status, user reviews, and risk assessments.

The platforms features, including risk ratings and alerts for unlicensed or suspicious entities, help users identify potential red flags. By researching a broker's background using WikiFX, individuals can make informed decisions and reduce the likelihood of falling victim to fraudulent schemes.

With its focus on transparency and investor protection, WikiFX empowers users to safeguard their investments and avoid financial losses.