HIJA MARKETS Scam Alert: Forex Trading & Investment Risk

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract: In this article, we will look in-depth at ZFX, examining its key features.

In this article, we will look in-depth at ZFX, examining its key features.

About ZFX

Name: ZFX

Registered Country: /Region: United Kingdom

Website: www.zealmarkets.com

Phone: +44(0)2071579968;

Address: No. 1 Royal Exchange, London, EC3V 3DG, United Kingdom; Office 1, Unit 3, 1st Floor, Dekk Complex, Plaisance, Mahe, Seychelles; Suite C, Orion Mall, Palm Street, Victoria, Mahe, Seychelles

Email: support@zfx.co.uk; cs@zfx.com

In an era of advancing technology and prevailing investment trends, many individuals have turned to using their smartphones for the stock market, futures, and forex trading. Consequently, they encounter a crucial question: “How to choose a broker?” As a result, they often seek advice from platforms like Forex Scam Alert. Given the recent influx of inquiries regarding ZFX Mountain and Sea Securities, today we will share insights on how to evaluate this platform.

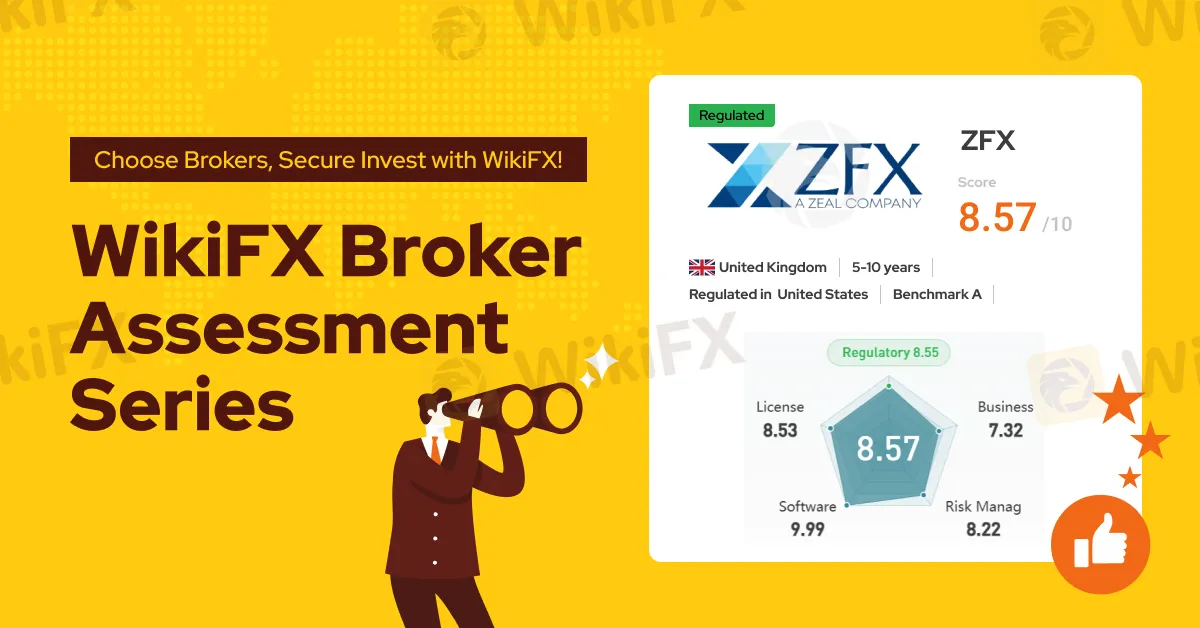

A search on WikiFX reveals that ZFX, a forex broker established for 5-10 years, employs the main trading software MT4/MT5. It holds a direct license from the UK's Financial Conduct Authority (FCA) and is regulated by the Seychelles Financial Services Authority (FSA) offshore. Additionally, it offers a “100% official intervention for complaints” service. WikiFX gives this broker a favorable score of 8.57/10.

Currently, ZFX offers three types of accounts for investors to choose from ECN, standard STP, and micro. The micro account has a minimum deposit limit of $50, a maximum leverage of 1:2000, and a minimum spread of 1.5. Both ECN and standard STP accounts have a maximum leverage of 1:500, with minimum spreads of 0.2 and 1.3 respectively, and require minimum deposits of $1000 and $200. All accounts support EA services.

ZFX's trading environment has an overall rating of AA, ranking 39th out of 130 brokers. Trading speed and costs are rated as A, while overnight costs and software disconnection are rated as AA, with the average disconnection frequency being deemed perfect.

On-Field Survey

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make an on-site survey on ZFX in May 2022 and successfully found their office.

Conclusion

Based on the above findings, ZFX, regulated by the UK's FCA, demonstrates a strong performance in its trading environment, making it a high-quality broker. Investors can decide whether to use it based on their circumstances. If you still want to learn about other brokers, consider using the “Broker Inquiry” feature on the WikiFX app to confirm relevant regulatory information, trading environments, and ratings, helping you find the ideal platform for your needs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

Picking a broker is one of the most important choices a trader can make. Beyond costs and trading platforms, the main protection for a trader's capital is the broker's regulatory status. A careful check of licenses, company registrations, and compliance history is not just smart; it is necessary. When it comes to Vida Markets, our review of public information shows major regulatory warning signs and a high-risk profile that should make any potential investor very careful. The main question of whether Vida Markets is a safe and regulated company is complicated, with an answer that points strongly toward a negative result. The broker's business structure is a mix of offshore registration, a license being used beyond its legal limits, and a recently canceled license from another country. This is made worse by an extremely low WikiFX score of 2.16 out of 10, a number that serves as an immediate and clear warning. Also, many serious user complaints create a worrying picture of the real tra

This 2026 Vida Markets review gives you a complete, fact-based look at this broker to answer one important question: Is this broker safe for traders? We looked at public information, government records, and many user reports to give you a clear and fair assessment. The most important finding is that this broker has an extremely low trust score of 2.16 out of 10 from WikiFX, a global financial regulation inquiry app. This score comes with a clear warning: "Low score, please stay away!" This poor rating isn't random - it emerges from serious problems with regulations, including a canceled license, and many customer complaints. These complaints claim serious wrongdoing related to keeping funds safe, canceling profits, and unfair trading practices. This review will break down these warning signs in detail, giving you the information you need to make a smart decision about your capital's safety.