Abstract:Amidst the volatile realm of forex trading, WikiFX stands tall, championing a decade-long commitment to fortify the market's integrity, empowering traders worldwide with confidence and informed decision-making.

In the fast-paced world of forex trading, where fortunes can be made or lost in the blink of an eye, the importance of a trustworthy and reliable information source cannot be overstated. For over a decade, WikiFX has been at the forefront of promoting a safer forex market for traders worldwide, carrying the torch of social responsibility to ensure that investors can navigate the intricate landscape of forex trading with confidence and peace of mind.

The forex market is dynamic and ever-evolving, making it a hotspot for traders looking to capitalize on exchange rate fluctuations. However, this very dynamism has its drawbacks. Unscrupulous individuals and entities often exploit the market's complexity to engage in unethical behavior, putting traders at risk. Investors face challenges such as fraudulent brokers, misinformation, and a lack of transparency, which can lead to devastating financial losses.

WikiFX, as a leading global third-party forex industry information service platform, has made it its mission to address these challenges. The platform leverages extensive data accumulation and advanced financial technology to provide comprehensive broker information verification services. These services empower traders with the knowledge they need to make informed decisions, mitigating the risks associated with forex trading.

One of the key ways in which WikiFX carries its social responsibility is by promoting transparency and accountability in the forex industry. The platform's WikiFX Rating System, a groundbreaking evaluation tool for forex brokers, collects publicly available information about forex broker qualifications and activities. It assesses brokers comprehensively across dimensions such as regulatory status, fund security, trading costs, trade execution, product services, and more. By providing these ratings, WikiFX encourages brokers to maintain high standards and act ethically.

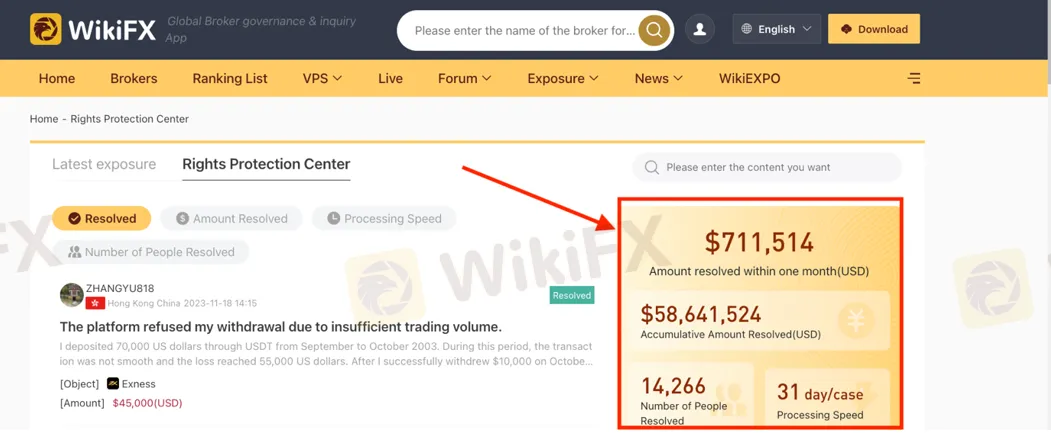

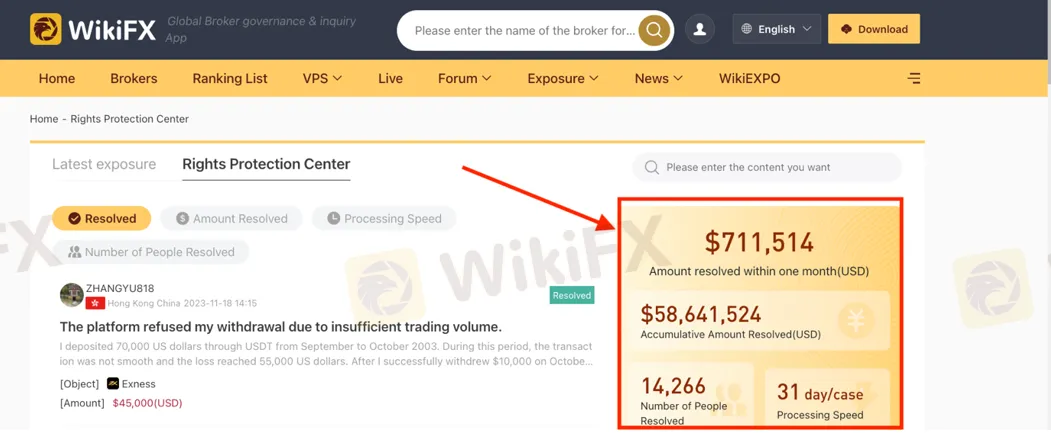

WikiFX also plays an essential role in exposing unethical behavior in the forex market. Its Exposure Service allows investors to post content related to risky situations and provides a platform for submitting relevant evidence. WikiFX then investigates and assesses brokers engaged in risky activities based on investor complaints. This not only adjusts credibility ratings accordingly but also assists investors in seeking justice. To date, WikiFX has helped over 14,200 victims recover more than $58.6 million in funds. This highlights the platform's commitment to upholding industry ethics and protecting traders' rights.

WikiFX actively supports and promotes industry self-regulation. By offering a transparent and reliable platform for traders, brokers are encouraged to maintain a high level of professionalism and ethics. High-quality brokers can showcase their strengths comprehensively, while those engaged in unethical behavior have nowhere to hide. This encourages healthy competition in the industry, and traders can benefit from a marketplace with higher ethical standards.

As a beacon of trust and a guardian of ethical behavior, WikiFX continues to light the way for traders globally, ensuring that the forex market remains a place where individuals can pursue their financial dreams with confidence and security.

Without further ado, download your free WikFX mobile application from Google Play/App Store now! Or visit https://www.wikifx.com for more invaluable information!