Abstract:The S&P 500 sank 1.6% on Wednesday in the aftermath of March’s Federal Reserve interest rate decision and accompanying press conference from Chair Jerome Powell.

S&P 500, US DOLLAR, JEROME POWELL, JANET YELLEN – ASIA PACIFIC MARKET OPEN:

The S&P 500 sank 1.6% in the aftermath of the Fed rate decision

Chair Jerome Powell tried pouring cold water on rate cut bets

Meanwhile, Janet Yellen testimony compounded risk aversion

Asia-Pacific markets appear to be bracing for volatility next

Asia-Pacific Market Briefing – Markets Reverse Gains on Fed Rate Decision

The S&P 500 sank 1.6% on Wednesday in the aftermath of Marchs Federal Reserve interest rate decision and accompanying press conference from Chair Jerome Powell. The central bank raised borrowing costs by 25 basis points, bringing the target range to 4.75% - 5%. Initially, markets welcomed the event as the statement noted that policymakers “anticipate” some extra firming might be appropriate.

That was cautiously downgraded from “ongoing increases” in the February statement, which was before Silicon Valley Bank collapsed earlier this month, triggering financial woes in the bank sector. But, markets turned after Jerome Powell noted that officials “just don‘t” see the case for rate cut this year. Since SVB’s bankruptcy, markets have been aggressively pricing in rate cuts this year.

A closer look reveals that median FOMC interest rate projections are still far more hawkish than what markets expect this year. Powell also stressed that if need be, they will raise rates higher than expected. The central bank also stressed that US banks are sound and resilient. Meanwhile, during Powells press conference, Treasury Secretary Janet Yellen was delivering testimony.

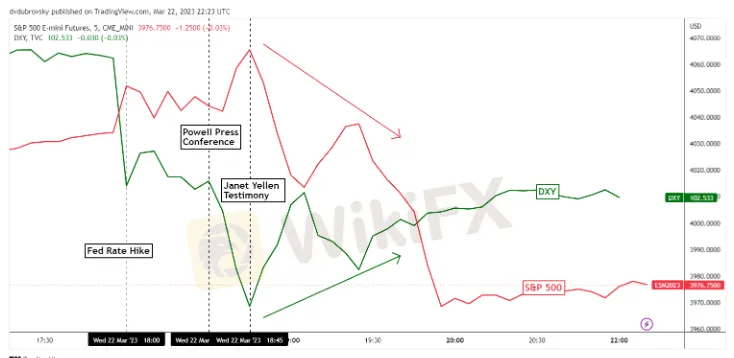

She noted that the government is not looking at offering “blanket” deposit insurance to stabilize the banking sector. This amplified selling pressure in regional banks, with First Republic Bank down over 15% by the end of the day. In the chart below, you can get a better idea of how price action evolved throughout these events and how the S&P 500 reversed and the US Dollar bottomed.

With that in mind, this is leaving Asia-Pacific markets vulnerable heading into Thursday‘s trading session. A lack of economic event risk is placing the focus on general market sentiment. As such, follow-through could dampen the mood for Japan’s Nikkei 225 and Hong Kongs Hang Seng Index. This may also offer some light for the US Dollar.

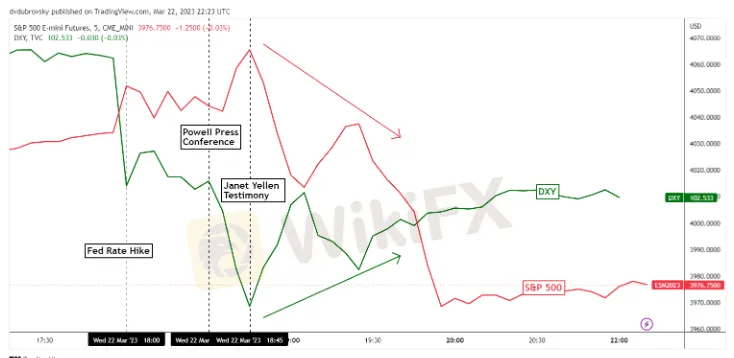

S&P 500 Technical Analysis

On the daily chart, the S&P 500 left behind a Bearish Engulfing candlestick. This followed what appears to have been a false breakout under a near-term falling channel from February. Further downside progress could open the door to resuming the downtrend. Immediate support is the 38.2% Fibonacci retracement level at 3938. Resistance is the 23.6% point at 4041.