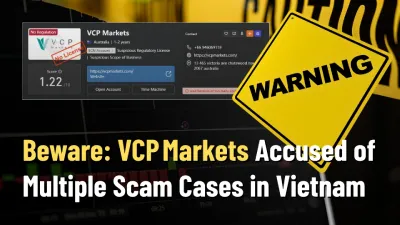

Beware: VCP Markets Accused of Multiple Scam Cases in Vietnam

Beware, Vietnam traders! VCP Markets faces a surge in 2025 complaints about blocked withdrawals and losses. Check verified reports on WikiFX now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:David Castleman, the court-appointed temporary receiver over EminiFX, Inc and certain assets of Eddy Alexandre has provided an update to the Court on the initial status of the Receivership.

David Castleman, the court-appointed temporary receiver over EminiFX, Inc and certain assets of Eddy Alexandre has provided an update to the Court on the initial status of the Receivership.

Lets recall that the CFTC launched an action against EminiFX in May 2022. The CFTC complaint alleged numerous violations of the federal commodities laws in a “Ponzi- like” scheme whereby the defendants pooled at least $59 million from hundreds of members of the general public, to purportedly trade Forex and cryptocurrencies as well as futures and options in an investment club.

Alexandre allegedly promised outsized returns of 5% to 9.99% per week and gave the impression that EminiFX was profitably trading the participants contributions, which was false. Instead, the Complaint alleges, although his trading at an online brokerage racked up over $6 million in losses, Alexandre misappropriated over $14.7 million for his personal accounts and continued to report to participants that their account balances were actually increasing by 5% to 9.99% every week.

The Receiver announced today that over $62 million was frozen in a number of accounts in both EminiFX‘s and Alexandre’s name, located at banks, brokerages, and cryptocurrency exchanges.

Although his review and analysis is at its earliest stages and is ongoing, it appears that there are at least 62,000 active EminiFX user accounts, of which the Receiver has been informed that between 25,000 and 50,000 were actively “trading” on the EminiFX platform.

Deposits into accounts appear to have initially been made by a combination of cash, and wire transfer into Bank 1 and Bank 2 using US Dollars, but then around March the number of users appears to have skyrocketed, at which point both deposits and redemptions were largely made through Crypto Exchange using Bitcoin. The Receiver is working with his forensics team to determine the extent of the transaction data recovered, and believes such data will be instrumental in an eventual claims and distribution process.

The Receiver immediately created a website to inform investors of the receivership, and his firm was immediately inundated with thousands of emails and calls from investors seeking information. In order to streamline the process and mitigate costs, the Receiver immediately created a separate email box for investors to send information. To date, over 8,000 emails have already been sent to that email address.

The Receiver has taken steps to secure the receivership estate and to prepare to wind down the operations of EminiFX and to begin instituting a robust notice, claims and distribution process in light of the discovery that there were over 62,000 active users of EminiFX.

The Receiver is not aware of any legitimate business activity of EminiFX that requires the ongoing use of the company. The Receiver, therefore, seeks to wind down the operations in an orderly fashion.

The Receiver has begun discussions with specialists to liquidate the inventory of EminiFX (largely computer equipment) once all the data has been secured, with the exception of any key systems which the Receiver may maintain. The Receiver will also terminate any service contracts no longer needed for the operation of the receivership. And the Receiver has also begun discussions with the landlord of the premises to begin re-leasing the majority of the offices and expects to vacate the balance of the premises as soon as practicable.

The Receiver has also engaged tax professionals to discover whether 2021 taxes were in fact filed, and to ensure that the estate is in compliance with all federal, state and local tax laws.

The Receiver has begun the process of turning over the EminiFX accounts to the Receivership estate, which will result in over $53 million in cash, the vast majority of which the Receiver expects will be available for eventual distribution to investors. The Receiver expects to turn over the assets in Alexandres name, currently frozen, that he has identified are derived from customer funds, into a segregated account until a determination or agreement can be made concerning whether those assets properly part of the receivership estate.

The Receiver also plans to pursue any assets stored at Crypto Exchange, as well as unwinding the recent real estate activities of EminiFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Beware, Vietnam traders! VCP Markets faces a surge in 2025 complaints about blocked withdrawals and losses. Check verified reports on WikiFX now.

Before thinking about ZarVista, you need to understand the complete picture. At first glance, ZarVista (which used to be called Zara FX) presents itself as a modern, feature-packed trading company. It advertises appealing trading terms, different account options, and the powerful MetaTrader 5 platform. However, our detailed research shows a completely different reality. This broker has major warning signs, an extremely low trust rating, and a high-risk business model. This ZarVista review will examine the broker's promises, comparing what it advertises with actual evidence. We will explore the ZarVista Pros and Cons by looking at its rules and regulations, platform features, and most importantly, the large number of user complaints that show a troubling pattern. This investigation is based on careful analysis of information from independent verification websites like WikiFX, giving you an objective and fact-based review to help you make a smart decision and protect your capital.

If you are asking, "Is XeOne safe or a scam?", you are doing important research before exposing your capital. This is the most important question any trader can ask about a broker. In this review, we will give you a clear, fact-based answer to help you make a smart choice. Online trading offers numerous opportunities, but it also has risks, so checking thoroughly is essential. Our article's main point is simple: when we look at XeOne's rules and real user reviews, we find serious warning signs that any potential trader should know about. We will be direct with you. The evidence shows this is an extremely risky situation for traders. To show this, we will first look at the most important factor: government oversight. Then we will examine the specific types of complaints from real users, compare them with positive reviews, and give you our final judgment based on all the evidence. Our review uses public information and user reviews collected by WikiFX, a worldwide broker regulation inq

When traders ask, "Is ZarVista legit?", the evidence points to a clear conclusion: ZarVista operates as a high-risk company. Based on our detailed investigation, this broker shows many warning signs that should make any potential investor very careful. While it looks like a modern trading platform on the surface, this appearance is seriously damaged by major regulatory issues, a host of user complaints, and a lack of clear business operations. The broker's low trust score of 2.07 out of 10 on the regulatory-checking platform WikiFX shows just how serious these problems are. Read on for more details.