ACY Securities Review: $40k Profits Withheld in Singapore

ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A look at the day ahead in markets from Alun John

Fed policymakers surged out of the traps last night, telling markets not to get too excited by the cooler-than-expected inflation reading, but to little avail.

The Nasdaq closed up 20% from its June low, the dollar tumbled after the data, and even bitcoin – remember that? – is back above $24,000 and testing a two-month high.

The Fed is “far, far away from declaring victory” on inflation, said Minneapolis Federal Reserve Bank President Neel Kashkari, despite noting the “welcome” news in the CPI report.

Inflation was flat in July, month on month, after advancing 1.3% in June, though was still up 8.5% compared to a year ago.

Chicago Fed President Charles Evans joined in the chorus, saying inflation was still “unacceptably” high.

Nonetheless, Asian shares kept the rally going – MSCIs broadest index of Asia Pacific shares outside Japan was up 1.3% to a six week high – and European futures are also pointing to a higher open,

Whether Europe will end up in the same goldilocks scenario as across the Pacific remains to be seen. British GDP data on Friday seems unlikely to offer as positive a lead into next week‘s inflation data, as last week’s U.S. jobs data did for the U.S. numbers.

Major European earnings on Thursdays agenda come with a German accent, with Zurich Insurance, Deutsche Telekom, Siemens all due, followed by U.S listed Chinese tech giant Baidu later in the day.

U.S. Inflation: A conflicting view?: https://tmsnrt.rs/3A6usjh

Key developments that could influence markets on Thursday:

Europe earnings: Zurich Insurance, Deutsche Telekom, Siemens, Thyssenkrupp,

US earnings: Baidu.com, Cardinal Health

US Jul PPI

US 30-year bond auction

Mexico central bank monetary policy statement

Peru, Serbia, central bank meetings

Defence ministers Ukraine, UK and Denmark host Ukraine donors conference, Copenhagen

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

Trust has always been a widely discussed topic in the forex industry. When genuine, rational voices are drowned out, market participants struggle to discern which information is trustworthy amid a sea of complex data. This difficulty in establishing trust has placed industry transparency at the forefront of attention.

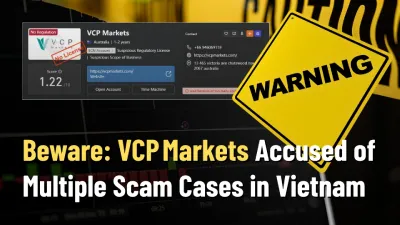

Beware, Vietnam traders! VCP Markets faces a surge in 2025 complaints about blocked withdrawals and losses. Check verified reports on WikiFX now.

Before thinking about ZarVista, you need to understand the complete picture. At first glance, ZarVista (which used to be called Zara FX) presents itself as a modern, feature-packed trading company. It advertises appealing trading terms, different account options, and the powerful MetaTrader 5 platform. However, our detailed research shows a completely different reality. This broker has major warning signs, an extremely low trust rating, and a high-risk business model. This ZarVista review will examine the broker's promises, comparing what it advertises with actual evidence. We will explore the ZarVista Pros and Cons by looking at its rules and regulations, platform features, and most importantly, the large number of user complaints that show a troubling pattern. This investigation is based on careful analysis of information from independent verification websites like WikiFX, giving you an objective and fact-based review to help you make a smart decision and protect your capital.