The U.S Dollar had a difficult year & technical analysis is revealing something unexpected...

What has happened to the U.S. dollar in 2025, and what can we expect in 2026?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:USD Whipsaws Despite Q1 GDP Smashing Expectations - US Market Open

MARKET DEVELOPMENT – USD Whipsaw Despite Q1 GDP Surge

DailyFX Q2 2019 FX Trading ForecastsUSD: The US Dollar saw a relatively choppy reaction to the Q1 GDP report. While headline surprised to the upside by quite some margin at 3.2% vs. Exp. 2.3%. The details however, were somewhat less convincing, particularly the PCE figures, meaning that while growth is running hot, inflation is not. Consequently, this places the Fed in a rather tricky situation. Within the GDP report temporary factors had been behind the surge with government spending and inventory accounting for 65% of the growth, while personal consumption had been soft.

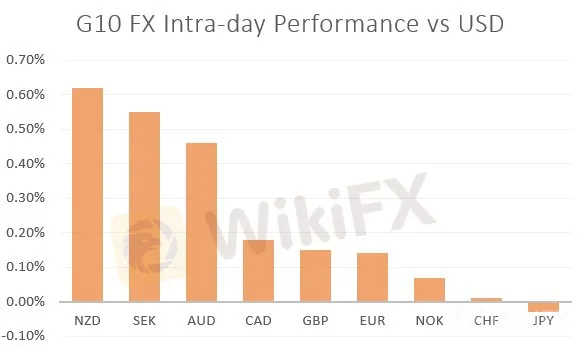

As such, in light of the softer inflation metrics and the surge in temporary factors, the USD had pared its initial gain, losing out to its major counterparts with both the EUR and AUD jumping to session highs, while US 10yr yields broke below 2.5%. Nonetheless, when comparing US growth to the RoW, the situation is much more supportive.

Source: Thomson Reuters, DailyFX

{5}

DailyFX Economic Calendar: – North American Releases

{5}

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

What has happened to the U.S. dollar in 2025, and what can we expect in 2026?

The US Dollar Index (DXY) remains steady near 98.00, supported by a mix of technical recovery and external currency weakness. While markets await definitive signals on the Fed's 2026 cutting cycle, technical breakdowns in major peers are driving price action.

The divergence between Federal Reserve guidance and market pricing is widening as traders position for 2026, setting the stage for significant volatility in the US Dollar. While the Fed’s latest dot plot conservatively suggests a single 25-basis-point rate cut in 2026, major financial institutions—including Goldman Sachs and Citi—are pricing in a more aggressive easing cycle of 50 to 75 basis points.

The market capitalization of the six largest US banks surged by approximately $600 billion in 2025, driven by a dual tailwind of financial deregulation and a resurgence in investment banking. This rally has widened the valuation divergence between American lenders and their European counterparts, reinforcing a theme of US financial exceptionalism that continues to influence global capital flows.