The U.S Dollar had a difficult year & technical analysis is revealing something unexpected...

What has happened to the U.S. dollar in 2025, and what can we expect in 2026?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:USD on the Brink of Range Breakout, EURUSD & GBPUSD suffer - US Market Open

MARKET DEVELOPMENT – USD on the Brink of Range Breakout, Euro & GBP suffer

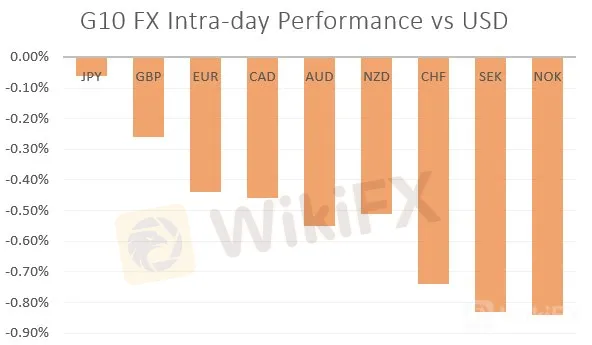

USD: Given the drop in FX volatility, the USD has continued to benefit, which in turn is now eying the top end of its multi-month range. Consequently, the push higher in the greenback saw Euro test support at the 1.12 handle, while GBP made a firm break below the 1.30.

Crude Oil: Oil prices remain firm as market participants continue to digest yesterday‘s announcement by the US to bring an end to Iranian oil waivers. However, gains have been somewhat modest throughout today’s session with Saudi Arabia talking up the possibility of boosting oil production in order to keep the oil market stable and thus keeping a lid on oil price spikes.

Gold: With the renewed bid in the greenback, gold prices were once again on the backfoot with the precious metal testing support at $1267. The outlook remains bearish in the short run with a break below $1262 opening up a move towards $1250.

Source: Thomson Reuters, DailyFX

DailyFX Economic Calendar: – North American Releases

IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

What has happened to the U.S. dollar in 2025, and what can we expect in 2026?

The US Dollar Index (DXY) remains steady near 98.00, supported by a mix of technical recovery and external currency weakness. While markets await definitive signals on the Fed's 2026 cutting cycle, technical breakdowns in major peers are driving price action.

The divergence between Federal Reserve guidance and market pricing is widening as traders position for 2026, setting the stage for significant volatility in the US Dollar. While the Fed’s latest dot plot conservatively suggests a single 25-basis-point rate cut in 2026, major financial institutions—including Goldman Sachs and Citi—are pricing in a more aggressive easing cycle of 50 to 75 basis points.

The market capitalization of the six largest US banks surged by approximately $600 billion in 2025, driven by a dual tailwind of financial deregulation and a resurgence in investment banking. This rally has widened the valuation divergence between American lenders and their European counterparts, reinforcing a theme of US financial exceptionalism that continues to influence global capital flows.