مقدمة عن الشركة

| The Capital Groupملخص المراجعة | |

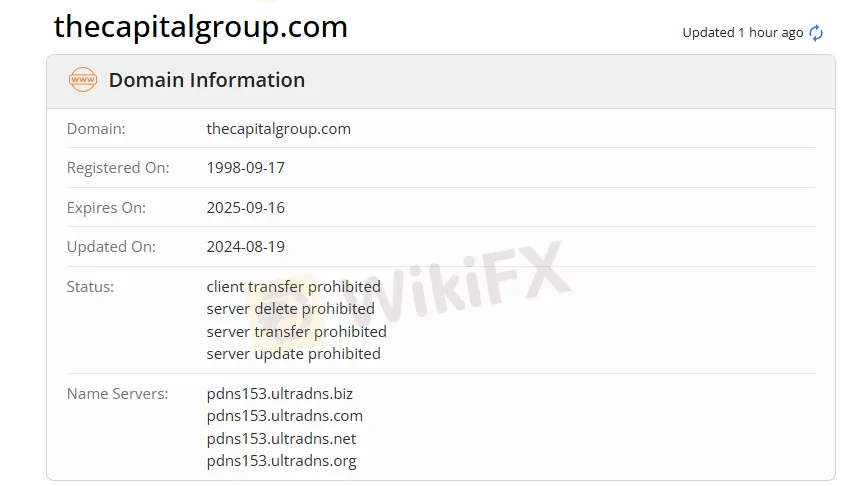

| تأسست | 1998 |

| البلد/المنطقة المسجلة | تايوان |

| التنظيم | بورصة تايبيه |

| أدوات السوق | أسهم، مستقبل |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| دعم العملاء | العنوان: الطابق 11، رقم 156، القسم 3، طريق منشنج الشرقي، منطقة سونغشان، مدينة تايبيه 105، تايوان (جمهورية الصين التقليدية) |

| هاتف: 886-2-412-8878 | |

| البريد الإلكتروني: service@capital.com.tw | |

معلومات The Capital Group

تأسست في عام 1998، The Capital Group مسجلة في تايوان ومنظمة من قبل بورصة تايبيه تحت إشراف غير معلن. تقدم تداول الأسهم والخيارات.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منظمة | نقص في أدوات التداول |

| عدم توفر حساب تجريبي | |

| MT4/MT5 غير متوفر | |

| نقص في معلومات الانتشار | |

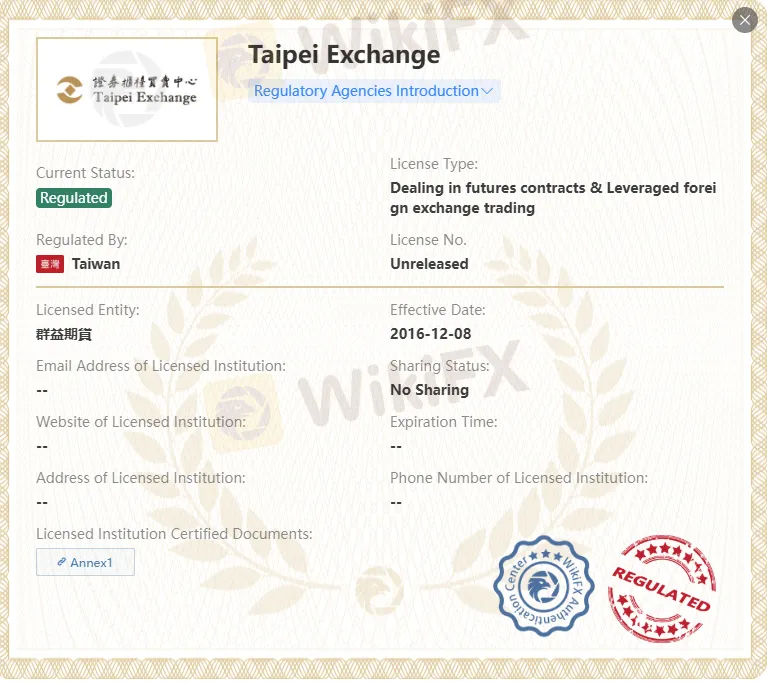

هل The Capital Group شرعية؟

نعم. The Capital Group مرخصة من قبل بورصة تايبيه لتقديم الخدمات.

| الهيئة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| بورصة تايبيه | منظم | The Capital Group | التعامل في عقود الآجلة وتداول العملات الأجنبية برهنية | غير معلن |

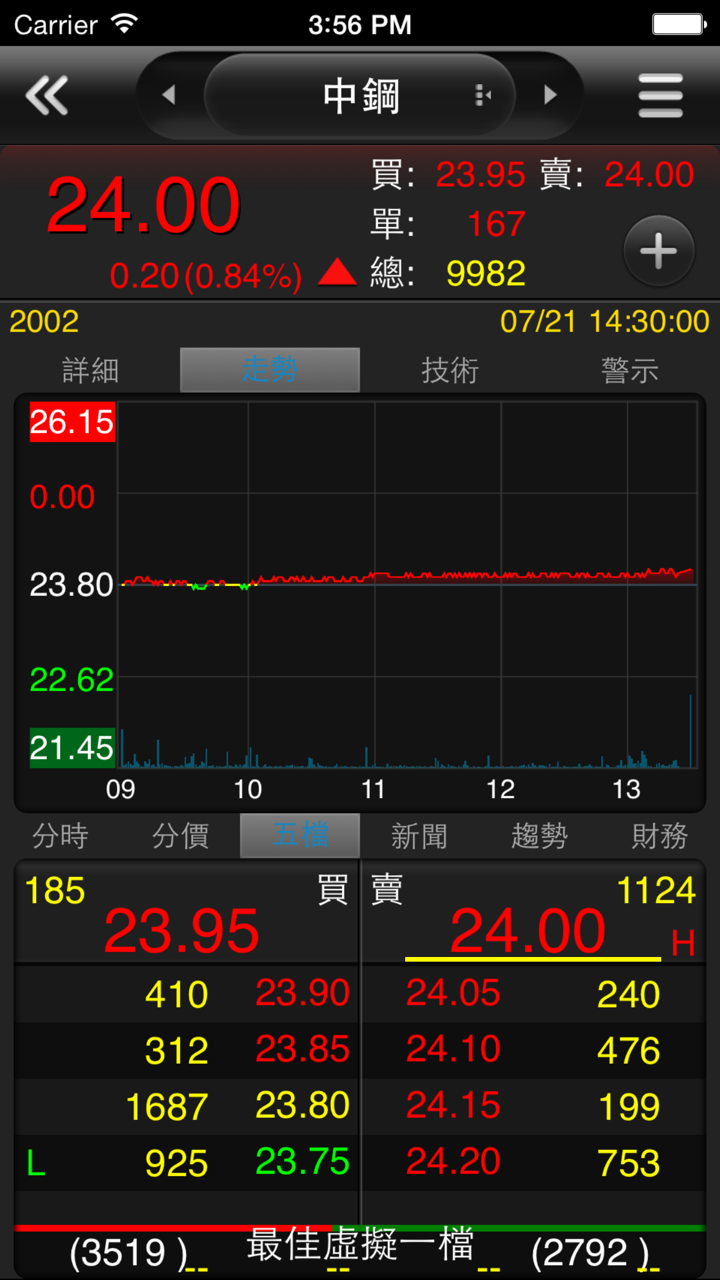

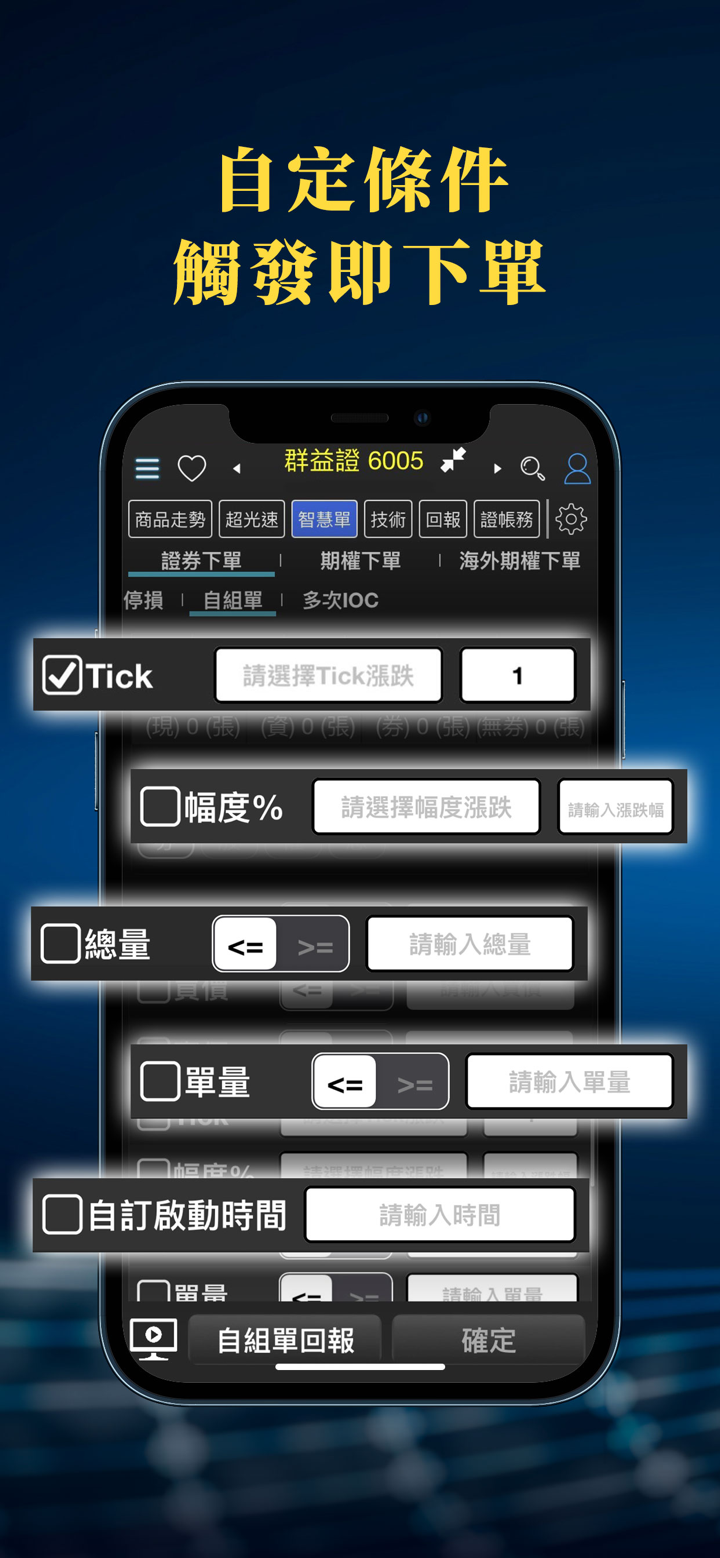

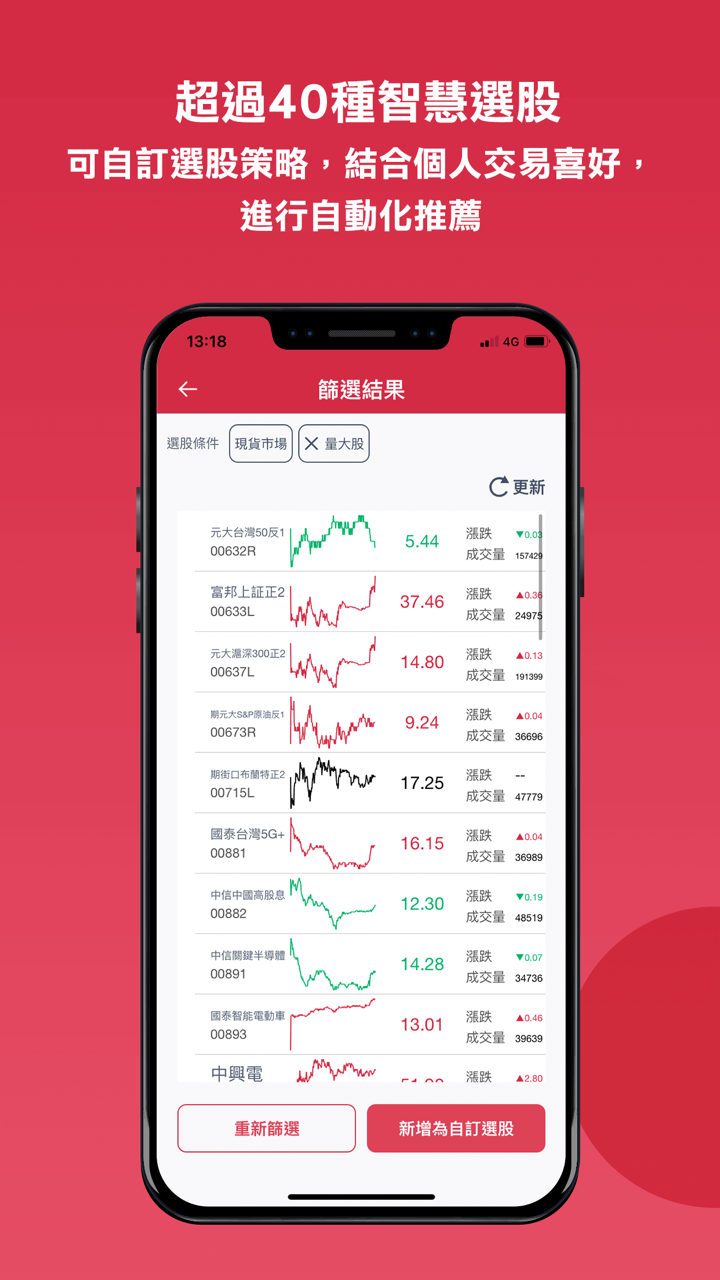

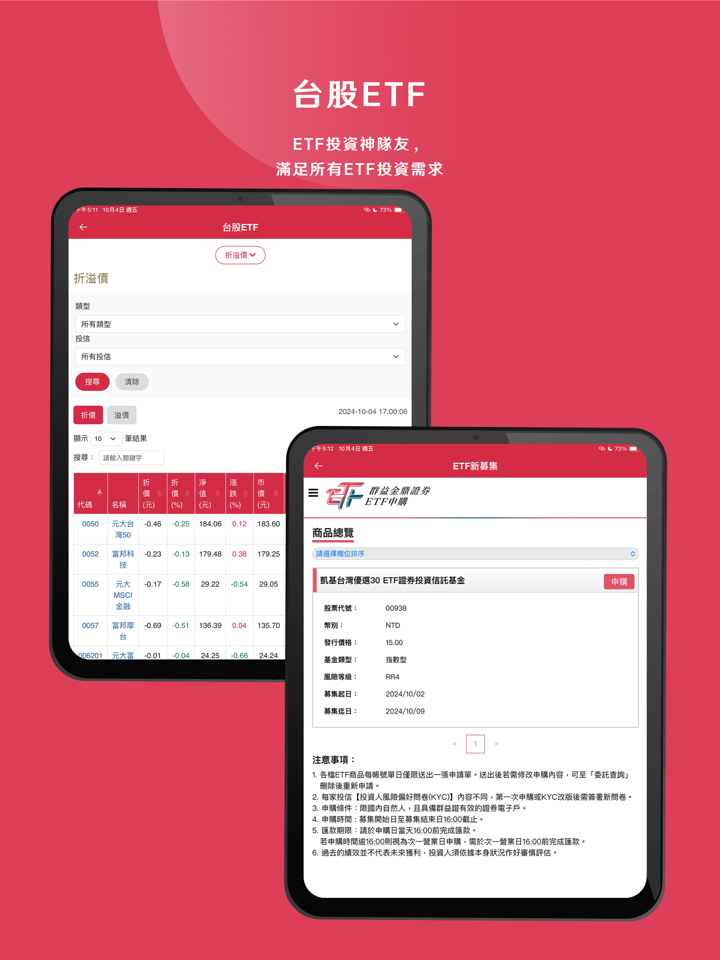

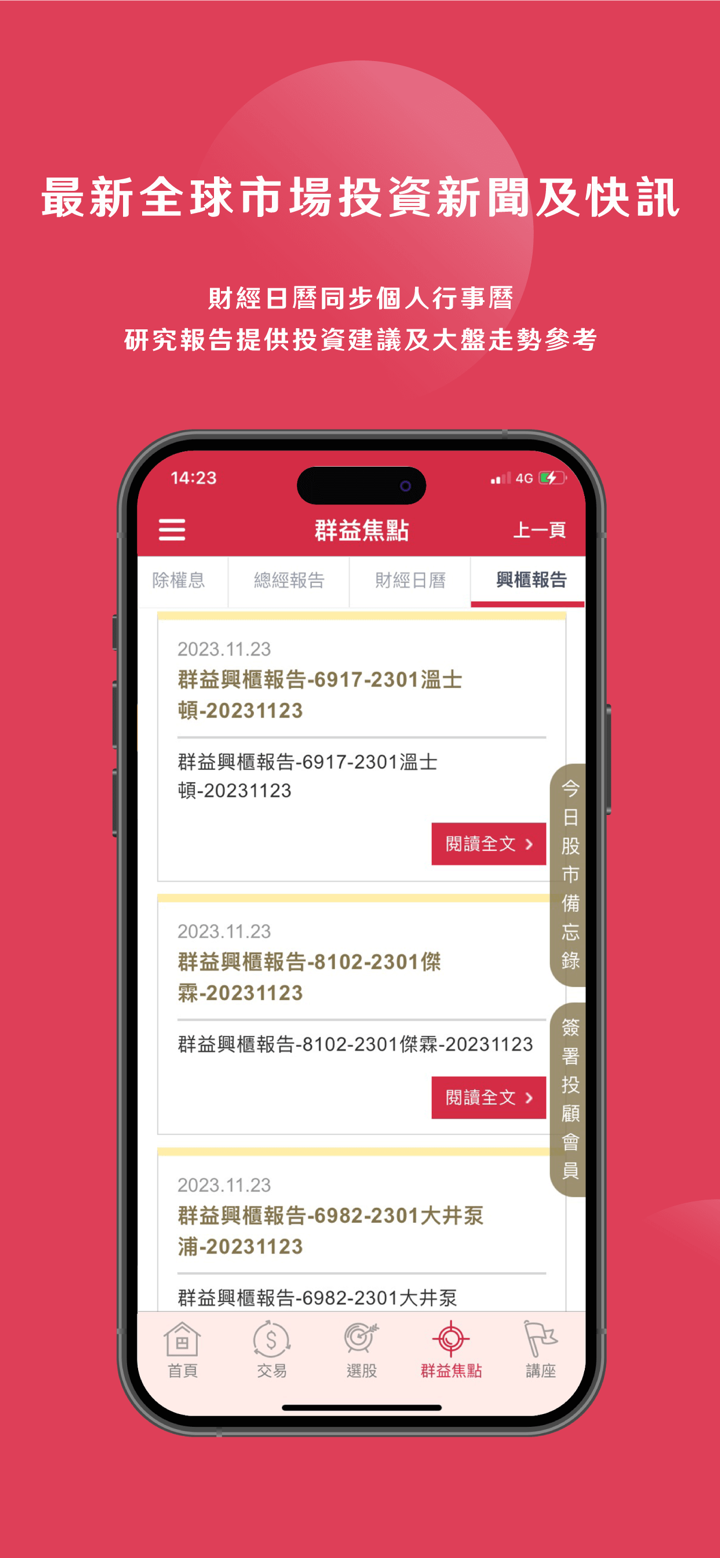

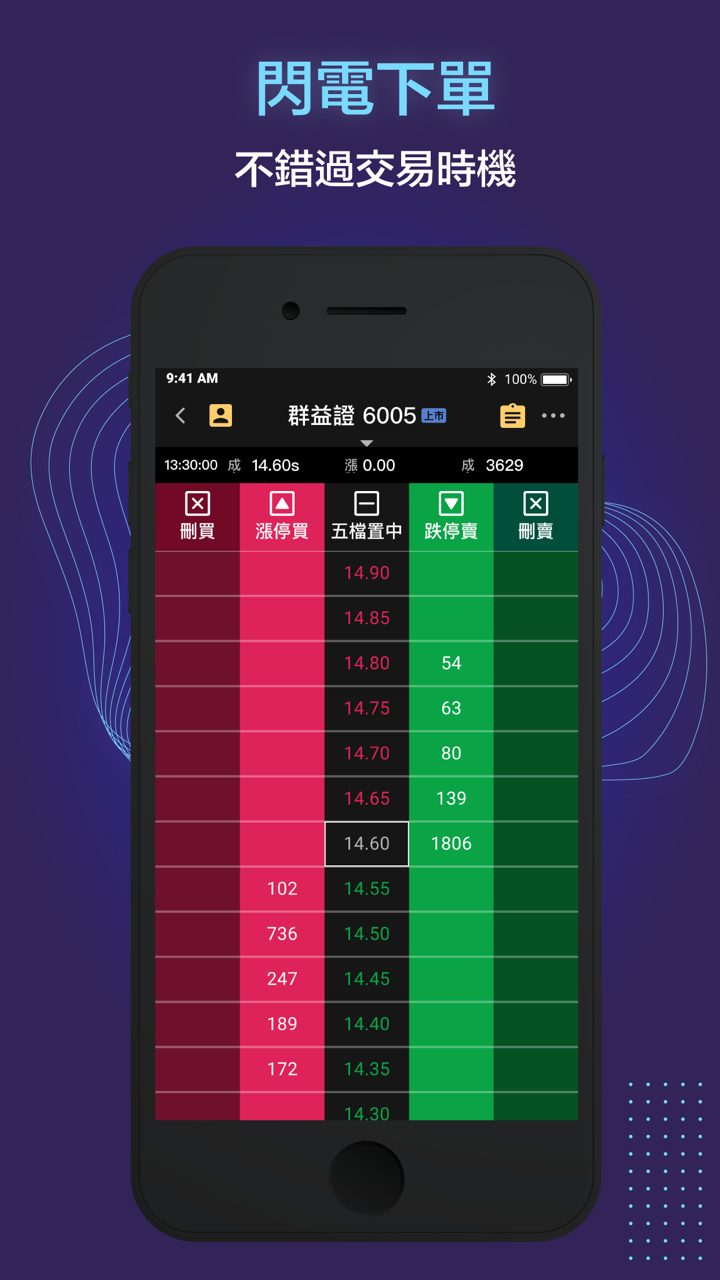

ما الذي يمكنني التداول به على The Capital Group؟

The Capital Group توفر تداول الأسهم والعقود الآجلة.

لا توجد تداول صناديق الاستثمار المتداولة بالبورصة أو تداول السندات. لن تحصل على مجموعة جيدة من الخيارات الاستثمارية.

| الأدوات التجارية | مدعومة |

| العقود الآجلة | ✔ |

| الأسهم | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة بالبورصة | ❌ |

FX3792673861

هونغ كونغ

市面上90%的骗局从“荐股”开始的!大多数骗局都是从“荐股”开始,往往那些所谓的“荐股大师”开始推荐的股票都会让你盈利一点点,在直播间或者是在群内推荐股票,慢慢取得你的信任后,开始推荐去做别的。在别的平台开.户操作。往往做别的开始也会让你盈利一点点,但是亏损一两次就会把你之前盈利的钱连本带利全都亏完,这时候老师会以各种理由敷衍你,说操作失误等等之类的话。然后叫你再入金,这时你不入金的话他就会把你踢出群,拉.黑删.除。如果你继续入金的话只会越陷越深!最后的结果也是一样亏空殆尽。 认清平台套路,避免上当受骗: 1、构建虚.假交易平台,不法人员往往是虚建包装成一个高大上的公司平台,给投资者传送模拟的交易软件,软件实际由他们控制。软件里投资产品的行情、价格走势都是他们自行设置,随他们掌控。 2、冻结客户资金,使其不能正常操作:在投资者盈利的时候,冻结投资者账户,使其买入之后不能正常卖出,然后其他操盘手将价格方向拉大,让投资者实际盈利变亏损。 3、在客户盈利时,强行平仓:美名其曰,避免你亏损,因为交易软件他们有后台控制,发现投资者盈利时,强制平仓。投资者因为往往都是网络开通账户,一无合同,二不知公司名称地址,往往被强制平仓后,无能为力,求告无门。 4、操作软件,控制行情:在交易平台中设置虚拟账户,进而对该账户虚拟注.资,进而通过虚拟资金控制交易行情,致使受害人亏损。 5、放大交易杠杆,设置资金放大比例数十或数百倍于受害人的“主力账户”,进而通过放大后的资金优势操作、控制市场行情,使受害人亏损

البلاغات

欧阳73633

هونغ كونغ

根本就沒有辦法出金,盈利賺錢了各種理由讓我教保證金,就是不讓我出金,一個勁的讓我買,我不明白,這麼大的平台不讓我出金

البلاغات

FX1460433056

تايلاند

لقد وفرت لك كابيتال جروب مجموعة من منتجات التداول ، من الأسهم إلى العقود الآجلة والخيارات والفوركس. هذا يعني أنه يمكنك توزيع استثماراتك عبر أسواق مختلفة وتقليل المخاطر. منصات التداول الخاصة بهم رائعة أيضًا ، مع كل الأجراس والصفارات التي تحتاجها للتداول وتتبع استثماراتك مثل المحترفين. أنا متحمس جدًا لمجموعة المنتجات والميزات التي يقدمونها.

التعليقات

S MD

سنغافورة

أن تكون كابيتال جروب خيارًا رائعًا نظرًا لرسومها وعمولاتها التنافسية. لا توجد رسوم أو رسوم خفية ، وهي ميزة كبيرة بالنسبة لي. يقدم الوسيط فروق أسعار منخفضة وأسعار شفافة ، مما يجعل التداول معهم تجربة فعالة من حيث التكلفة. أنا أقدر حقيقة أنني لا أتعرض لرسوم أو مصاريف غير متوقعة ، ويمكنني بسهولة حساب تكلفة تداولاتي.

إيجابي

FX1036206024

الأرجنتين

لا يوجد الكثير لأقوله ، أعتقد أن الخدمة التي تقدمها كابيتال جروب مرضية بالنسبة لي. الأمان هو أهم شيء عندما أختار وسيطًا ، وأموالي آمنة الآن.

إيجابي