مقدمة عن الشركة

| DXtradeملخص المراجعة | |

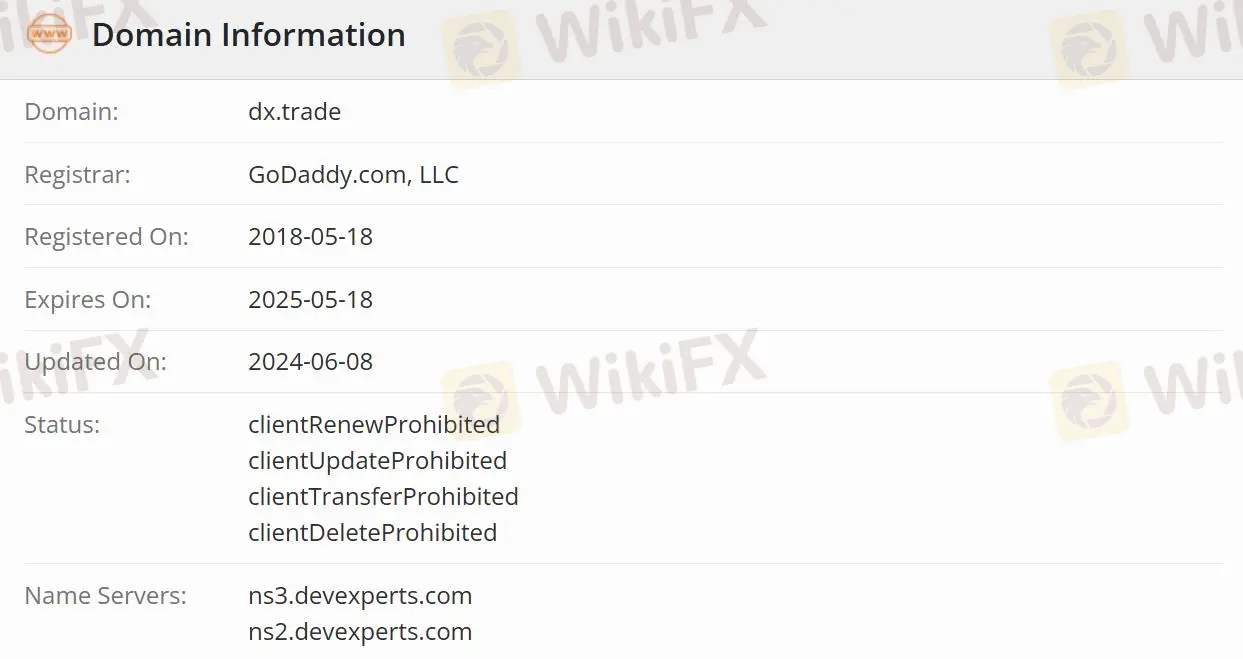

| تأسست | 2018-05-18 |

| البلد/المنطقة المسجلة | أيرلندا |

| التنظيم | غير منظم |

| حساب تجريبي | ✅ |

| منصة التداول | DXtrade CFD(Web/Mobile)/DXtrade XT((Web/Mobile)/تكنولوجيا التداول الخاصة |

| دعم العملاء | هاتف: +1 201 685 9280 |

| وسائل التواصل الاجتماعي: فيسبوك، تويتر، يوتيوب، لينكد إن | |

معلومات DXtrade

DXtrade هي شركة برمجيات وشركة منتجات تقنية المعلومات تقوم بتطوير برامج لشركات صناعة الخدمات المالية منذ عام 2002. الخبرة الأساسية في الأعمال هي منصات التداول، وتحديداً DXtrade XT للأوراق المالية المدرجة والمشتقات، DXtrade CFD لفئات الأصول خارج البورصة، و DXtrade Crypto للعملات الرقمية. هذا الحساب التجريبي ليس للمتداولين. إنه خدمة مصممة للوسطاء وشركات الاستثمار الخاصة لتجربة برامج DXtrade.

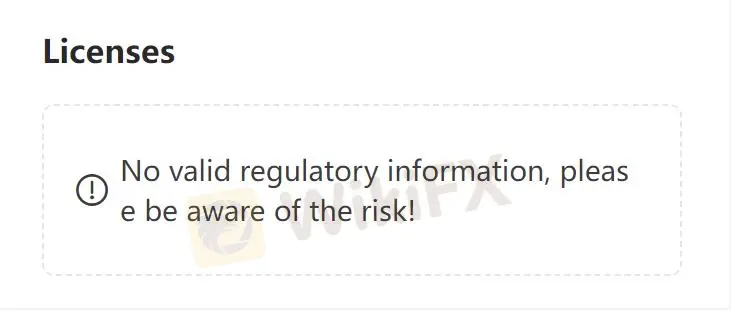

هل DXtrade شرعية؟

DXtrade غير منظمة، مما يجعلها أقل أمانًا من الوسطاء المنظمين.

ما هي منصة التداول التي يوفرها DXtrade؟

DXtrade يوفر الوصول إلى DXtrade CFD، DXtrade XT، وتكنولوجيا التداول الخاصة. تتوفر على الويب والهاتف المحمول. منصة التداول DXtrade CFD لوسطاء الفوركس والعقود مقابل الفروقات والعملات الرقمية والرهانات المنتشرة؛ منصة التداول DXtrade XT للوسطاء الذين يقدمون الأسهم والخيارات والعقود الآجلة وصناديق الاستثمار المشتركة والسندات؛ DXtrade هي منصة للتداول الخاصة ومسابقات التداول. يوفر تجربة مهنية لعملاء وسطاء البدء ووسطاء الاستثمار القائمين وشركات التداول الخاصة عند التداول في العملات الأجنبية والعقود مقابل الفروقات والعقود الآجلة.

| منصة التداول | مدعومة | الأجهزة المتاحة |

| DXtrade CFD | ✔ | الويب/الهاتف المحمول |

| DXtrade XT | ✔ | الويب/الهاتف المحمول |

| تكنولوجيا التداول الخاصة | ✔ | - |

خيارات دعم العملاء

يمكن للمتداولين متابعة المنصة على فيسبوك وتويتر ويوتيوب ولينكد إن والاتصال بها عبر الهاتف.

| خيارات الاتصال | التفاصيل |

| هاتف | +1 201 685 9280 |

| وسائل التواصل الاجتماعي | فيسبوك، تويتر، يوتيوب، لينكد إن |

| اللغة المدعومة | الإنجليزية/الإسبانية |

| لغة الموقع | الإنجليزية/الإسبانية |

| العنوان الفعلي |